Shares of Lithium Americas Corp. (LAC) surged nearly 33% in pre-market trading after the U.S. government confirmed that it was taking a minority stake in the company. On Tuesday, Energy Secretary Chris Wright told Bloomberg Television that the U.S. Department of Energy (DOE) plans to take a 5% equity stake in LAC, along with a 5% stake in its Thacker Pass project. Notably, automaker General Motors (GM) also holds a minority stake in the Nevada-based lithium mine.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Lithium Americas Corp. is engaged in the exploration and production of lithium, a critical mineral used in electric vehicle (EV) batteries, energy storage, wind turbines, and consumer electronics. Although LAC is domiciled in Canada, its shares trade on both the New York Stock Exchange and the Toronto Stock Exchange. Commenting on the DOE’s investment, Wright stated, “It’s in America’s best interest to get that mine built.”

Here’s Why the Stake Is Crucial for the White House

China remains the largest producer of lithium, with the U.S. and other countries being heavily reliant on Chinese supplies. By ramping up production of high-grade lithium in LAC’s North American mines, the White House aims to break China’s dominance and secure a domestic supply chain.

The Thacker Pass project is expected to become one of the world’s largest lithium sources, with the first phase of operations set to begin in 2027. Once fully operational, it is projected to produce about 40,000 metric tons per year of battery-grade lithium carbonate, a key requirement for lithium-ion batteries.

LAC and GM Struggle for Finances

Last week, a Reuters report suggested that Lithium Americas and General Motors were negotiating with the DOE over terms of a $2.3 billion federal loan to help fund the Thacker Pass project. As part of those negotiations, the government had hinted at taking a small stake in LAC.

Nonetheless, officials wanted added protections, including outside equity and a binding supply deal from GM, after the partners requested to restructure the financing. The loan, approved in October 2024, supports building a lithium carbonate processing plant alongside their $2.2 billion mine.

Is LAC a Good Stock to Buy Now?

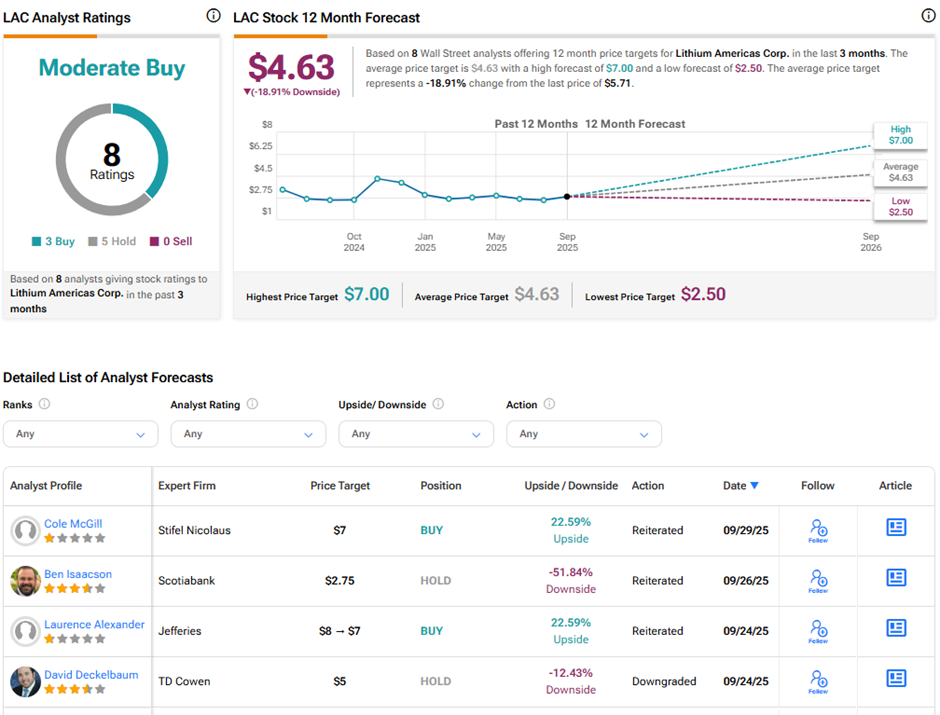

Analysts remain divided on Lithium Americas’ long-term outlook. On TipRanks, LAC stock has a Moderate Buy consensus rating based on three Buys and five Hold ratings. The average Lithium Americas price target of $4.63 implies 18.9% downside potential from current levels. Despite this cautious view, LAC stock has surged over 92% year-to-date.

Please note that these ratings were issued before the news of the government stake and may change once analysts revisit their views.