Shares of Lithium Americas (LAC) jumped 68% in pre-market trading on Wednesday after news that the U.S. government is in talks to take a stake in the company. The U.S. government is reportedly negotiating a stake in the company while revising a $2.3 billion loan from the Energy Department.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

For context, Lithium Americas is developing the Thacker Pass project in Nevada with General Motors (GM), with support from a U.S. Department of Energy loan. The project is set to supply lithium for electric vehicles and energy storage batteries, with operations expected to begin by 2028.

Trump Eyes Stake in Lithium Americas

According to Reuters, the Trump administration is seeking up to a 10% equity stake in Lithium Americas while renegotiating the $2.3 billion Energy Department loan for its Thacker Pass lithium project. Notably, the project was approved by Trump at the end of his first term, while the loan was granted during the Biden administration.

Meanwhile, a Trump administration official told Barron’s that “this is a great critical minerals deal,” without specifying the exact stake being sought. The official added that negotiations are still ongoing and the stake is small.

At the same time, a White House official told Reuters that President Trump supports the project but added, “There’s no such thing as free money.”

Trump Pushes to Strengthen US Manufacturing

The news comes as the Trump administration pushes to boost U.S. manufacturing through greater investment from both domestic and international companies. In particular, Lithium Americas’ deal could reshape America’s lithium supply chain. Both Republicans and Democrats support the project, showing how important it is for boosting U.S. critical mineral production and reducing reliance on China, the world’s top lithium producer.

Moreover, the proposed stake is the latest example of the Trump administration, after similar investments in Intel (INTC) and MP Materials (MP), aiming to support industries considered critical to national security.

Is LAC a Good Stock to Buy?

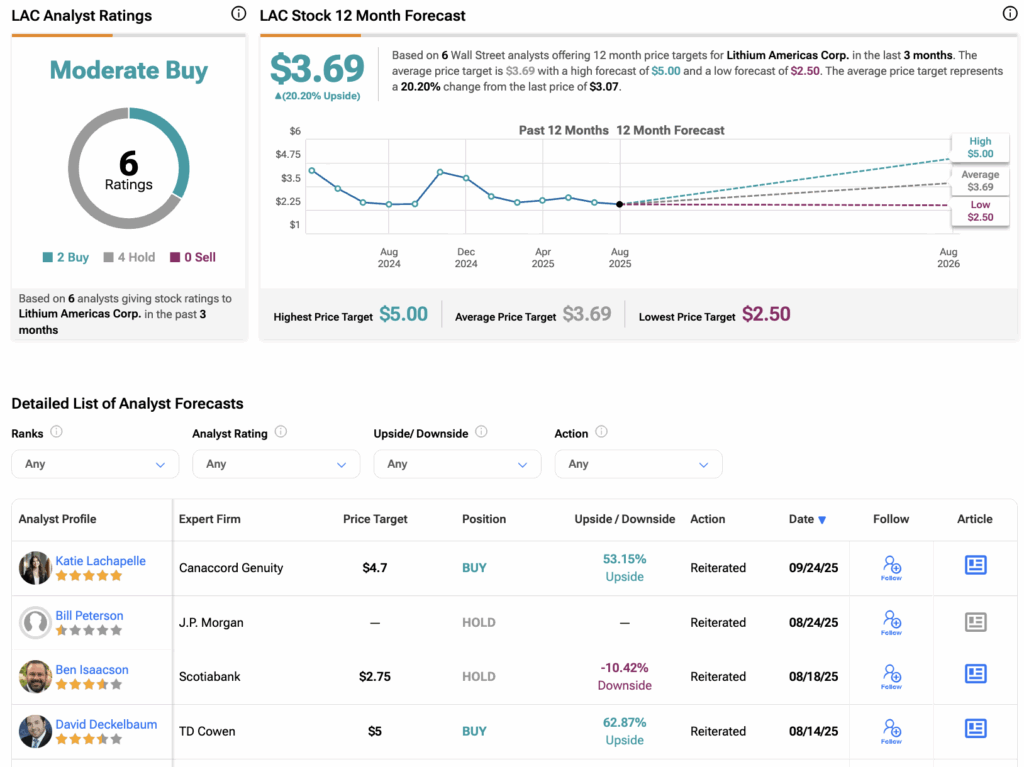

Turning to Wall Street, analysts have a Moderate Buy consensus rating on LAC stock based on two Buys and four Holds assigned in the past three months. Furthermore, the average LAC’s stock price target of $3.69 per share implies a 20% upside from current levels.