There is something to be said for the personal touch. Chip stock Intel (INTC) is about to see as much for itself. New CEO Lip-Bu Tan will be taking over the company’s artificial intelligence (AI) development operations itself, a move which has some enthusiastic and others quite concerned. Investors were among the concerned, as Intel shares slipped modestly in Tuesday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Intel lost its previous AI head, Sachin Katti, to OpenAI recently. Katti will now be handling compute infrastructure at OpenAI, which in turn will produce the groundwork for artificial general intelligence research. This leaves Intel very much in the lurch, and Tan himself will step in to fill in the gap.

A recent statement from Intel underscored the matter, saying in part, “AI remains one of Intel’s highest strategic priorities, and we are focused on executing our technology and product roadmap across emerging AI workloads.” Intel has struggled to keep up with AI developments in the past, and many believe that Intel effectively missed the boat, ceding the field to a range of competitors. But Intel looks eager to make a comeback, and with Tan himself stepping in, demonstrates the strategic importance of AI overall.

Real Estate Sales

Meanwhile, Intel’s ongoing cost-cutting measures have produced some very interesting effects, including recent moves to sell a building in Santa Clara to a real estate firm. The DiNapoli Family LP agreed to purchase 1501 Martin Avenue from Intel for $10 million, and plans to rehabilitate the building, already in the process of seeking tenants for it.

The building is 37,800 square feet in size, reports note, and regards the building as “…part of our core portfolio.” Further, DiNapoli noted, “We own a large number of industrial buildings and this fits in with those.” It also gives Intel some extra cash and gets a building it was likely under-utilizing off its own books.

Is Intel a Buy, Hold or Sell?

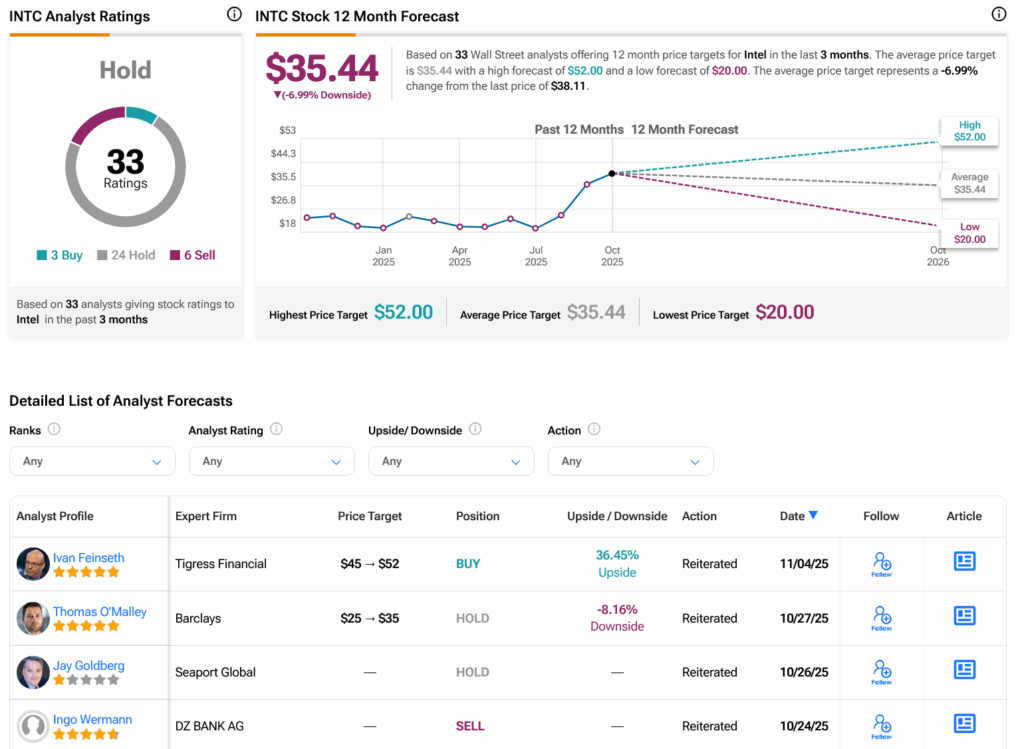

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on three Buys, 24 Holds and six Sells assigned in the past three months, as indicated by the graphic below. After a 59.15% rally in its share price over the past year, the average INTC price target of $35.44 per share implies 6.99% downside risk.