Chip stock Intel (INTC) desperately needs a win. In fact, it needs the biggest win it can get. And it may be on the cusp of just such a win with a recent report out of Tesla (TSLA). As it turns out, Tesla might be looking to Intel for a line of new artificial intelligence chips, and Intel could be the one to offer those chips. Intel investors were cautiously optimistic, sending shares up nearly 1.5% in Friday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Reports noted that Tesla was likely to have to build “…a gigantic chip fab” in order to build the necessary chips to power its artificial intelligence ambitions. It might have chosen to talk to Microsoft (MSFT), which at last report has more chips than it has electricity to operate. But instead, Tesla wondered if Intel would be up for the job, since Intel is already in the process of building chip fabs and has some in place already.

Intel declined to comment on this development, and Tesla made it clear that no deals have been signed with Intel on the matter. However, Tesla already has the chip in question, the AI5, ready to go. It has also set up deals with Taiwan Semiconductor Manufacturing Co. (TSM) and Samsung (SSNLF), but could be looking to Intel to round out some of the production. Tesla may also need producers for the AI6 chip, which uses the same fabs, but is expected to produce double the performance before 2028 is through.

An Unexpected Loss

But the news was not all good for Intel, as word emerged that it was losing one of its data center heavyweights to one of its biggest competitors, Advanced Micro Devices (AMD). The former vice president of data center AI product management, Saurabh Kulkarni, revealed that he was leaving the company as of today, Friday.

Kulkarni will join AMD in an unknown capacity, reports note, but given that Kulkarni was part of the leadership team developing the Gaudi accelerator, it likely has something to do with data center or AI operations. These are increasingly vital operations these days, so it is a safe bet that Intel’s loss is AMD’s gain.

Is Intel a Buy, Hold or Sell?

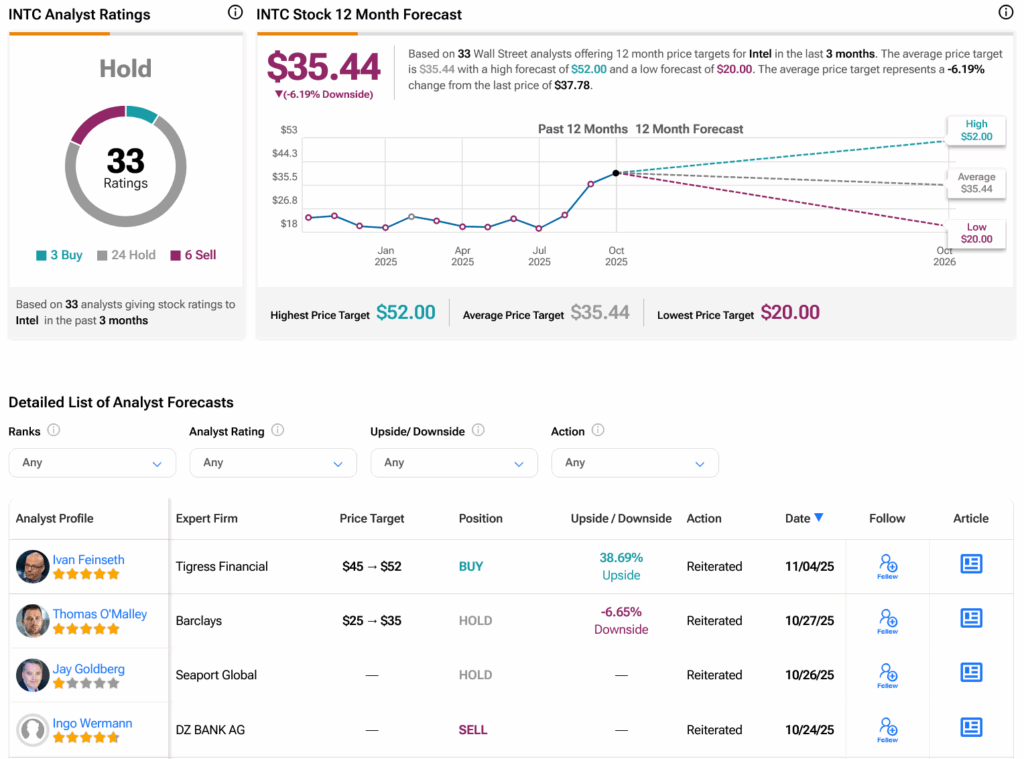

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on three Buys, 24 Holds and six Sells assigned in the past three months, as indicated by the graphic below. After a 42.14% rally in its share price over the past year, the average INTC price target of $35.44 per share implies 6.19% downside risk.