The last several weeks have been huge for chip stock Intel (INTC). A flood of news has emerged about this stock that once looked like a disaster in search of a start button. But with a host of deals, new investment, and cost-cutting on a terrifying scale, Intel has been turning things around. Analysts are starting to take notice, and investors are nodding assent. Those investors sent Intel shares up fractionally in Monday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Several different firms kicked in insight and perspective. The strength of Intel’s third-quarter earnings report, complete with an earnings beat, was enough for Morgan Stanley to hike its price target from its original $23 per share to $36. Truist also augmented its position, raising its target to $39 from the previous $21. Truist also called attention to Intel’s gains in foundry operations.

Not everyone sent price targets up so far, but there were plenty of other analysts raising the bar. Deutsche Bank analysts sent the price target on Intel from $23 to $30 thanks to ongoing and “aggressive” moves taken in pursuit of an improved balance sheet. Perhaps the best, though, went to Benchmark, who upgraded Intel to a Buy and added a $43 price target thanks to the Nvidia (NVDA) partnership.

The Ohio Question

There is one major issue left outstanding for Intel: the Intel Ohio One operation in New Albany. At last report, Intel has plans to expand operations, as well as keep going on the manufacturing plant in Ohio. But there is a potential risk that the Intel Ohio One project will be delayed, or possibly shut down altogether, without the customers required to keep the 14A process working and producing.

However, the good news here is that there seems to be hiring starting up for Ohio One. New positions are being advertised at the plant, which suggests that Intel looks for there to be an Ohio One plant, and for that plant to require staff.

Is Intel a Buy, Hold or Sell?

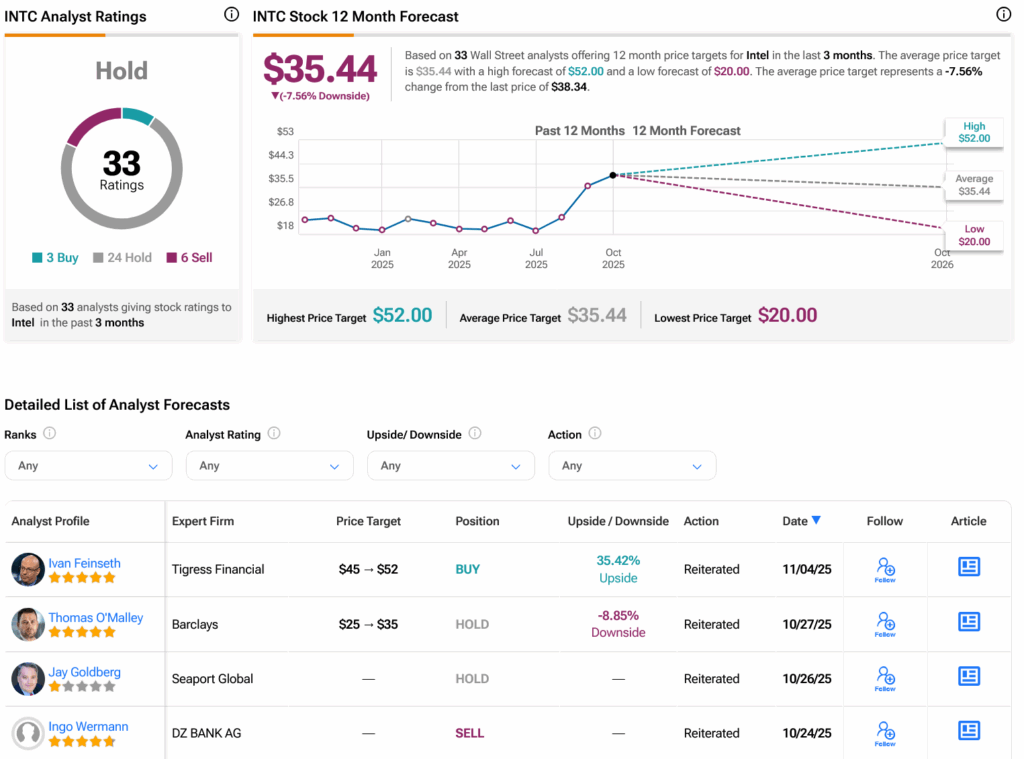

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on three Buys, 24 Holds and six Sells assigned in the past three months, as indicated by the graphic below. After a 52.22% rally in its share price over the past year, the average INTC price target of $35.44 per share implies 7.56% downside risk.