TipRanks Analysis page for Exchange-Traded Funds (ETF) displays the latest price chart, statistics, basic fund information, and the Smart Score for an ETF.

Let’s examine each of these invaluable tools by using the example of a popular ETF, the SPDR S&P 500 ETF Trust (SPY). To start, search for the SPY ETF using the search bar, by entering either the name of the fund or its ticker symbol. By default, when searching for an ETF, it will take you first to the ETF Analysis page.

# ETF Price Chart & Statistics

This chart provides you with the price movement of the ETF for various time periods, from a one-day period and right up to the time period that began with the inception of the fund. You can also see the fund’s daily trading range, 52-week trading range, previous closing price, average trading volume, and more, to help you study the ETF’s performance. You also have the option to choose the chart type, among a line chart, area chart, and candle chart.

Moreover, the chart gives you basic information about the ETF, including its assets under management (AUM), net asset value (NAV), Expense ratio, beta, and dividend information. In the chart below, you can see all the relevant details about the SPY ETF.

# ETF Smart Score

Just as we calculate the TipRanks Smart Score for stocks using our proprietary technology, we calculate the Smart Score for ETFs. This revolutionary measure is based on the weighted average Smart Score of each holding in the ETF and some additional factors. Weights are derived based on the number of stocks having a particular Smart Score.

For example, SPY has a Smart Score of 8, which is derived by a weighted average calculation. Under SPY’s holdings, 15.99% of stocks have a Smart Score of 10, 20.85% of stocks have a Smart Score of 9, and so on. We can see much of the information that’s included in the Smart Score on the ETF’s Holdings page, broken down into each individual stock’s parameters. Other data that’s included in the Smart Score, such as News Sentiment, Hedge Fund trends, Crowd Wisdom (retail investors), and Technical Factors are calculated based on the actual ETF ticker’s parameters.

TipRanks calculates the Smart Score based on a combination of all these factors and derives a ranking from 1 to 10, with 10 being the best, called the “Perfect 10” smart score. A lower score between 1 and 3 indicates that the ETF will underperform market expectations, a score between 4 and 7 implies the ETF will perform in line with market expectations, and a score between 8 and 10 implies the ETF will outperform market expectations.

# ETF Top 10 Holdings

Next comes the list of the top 10 holdings of the ETF along with their allocations in the fund. Below is a screenshot of SPY’s top 10 holdings with their weights. As seen in the chart, iPhone maker Apple (NASDAQ:AAPL) is the largest holding in SPY, with 6.71% weight in the fund. This is followed by tech giant Microsoft (NASDAQ:MSFT), with 5.70% weight, and e-commerce giant Amazon.com (NASDAQ:AMZN), with 2.54% weight.

# SPY ETF News

Right next to the top 10 holdings list, you will find all the latest news related to the particular ETF. You can click on any news quote to read the full article.

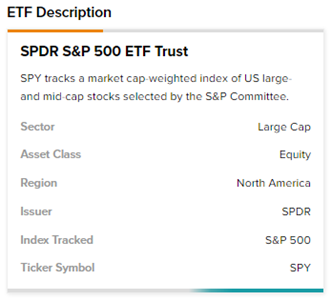

# ETF Description

Here, you will find the description of the ETF along with basic information including asset class, region-focus, index-tracked, the issuer of the ETF, and ticker symbol. As you can see, SPY is an S&P 500 index (SPX)-tracking ETF.

# ETF FAQ (Frequently Asked Questions)

At the bottom of the page, you find the frequently asked questions about the specific ETF. For example, What is the AUM of SPY? Which hedge fund is a major shareholder of SPY? and so on. You can click on each FAQ and find the answer in the dropdown below.

Now, go ahead, study an ETF on one of TipRanks’ unique ETF analysis pages, and access all the relevant information about the fund in one click.