There are two broad stock investing strategies — growth investing and value investing. These strategies are defined by the type of stocks that you buy. Investors are always looking for the right strategy with the goal of minimizing risks and maximizing returns, and an individual investor’s waiting period, reason for investing, and risk appetite will usually draw the path for stock picking.

To start with, let’s look at the basic definitions of the two major categories of stocks. Growth stocks are companies that are from an emerging sector, have better-than-average revenue growth, usually trade at higher multiples owing to their lucrative future prospects, and pay low or no dividends.

On the other hand, value stocks belong to companies from well-established sectors, have relatively stable financials, are considered undervalued, and usually have attractive dividend yields.

This brings us to the main question: which investment strategy is better for an investor? Let’s look at more detailed characteristics of both styles of stock investing.

What is Growth Investing?

A growth investor typically invests in firms that have higher revenue growth (and sometimes earnings and cash flow growth) compared to peers and the overall market. This strategy generally involves investing in market-leading companies from promising, innovative sectors. These stocks often have low dividend yields as most of the cash flows are reinvested in the business.

Even though growth stocks generally trade at high price/earnings (P/E) and price/sales (P/S) ratios, investors are willing to buy them in the hope of generating extraordinary returns in the long run.

Finally, investing in growth stocks includes higher risk and volatility compared to value investing, as they are highly sensitive to market expectations.

By its very nature, growth investing works best in times of favorable macroeconomic environment as this tends to boost a company’s growth and earnings potential. Growth investing may be ideal for investors with higher risk tolerance and a longer time horizon.

Below is a Screenshot of TipRanks’ Best Growth Stocks Comparison

What is Value Investing?

Value investing involves buying stocks of companies that currently trade at a significant discount to their intrinsic value but are fundamentally sound. These companies trade at lower valuations as markets have perceived some negative news about them as a sign to dump shares.

Further, value investing involves buying stocks of companies from mature sectors that have a wide consumer base and general product applications. This ensures that players in this sector will continue to witness perpetual demand for their products.

Remarkably, value investing is suitable for risk-averse, income-savvy investors that often invest in companies paying solid regular dividends. Most importantly, value investing works best in periods of macroeconomic instability as value stocks are less subject to market volatility.

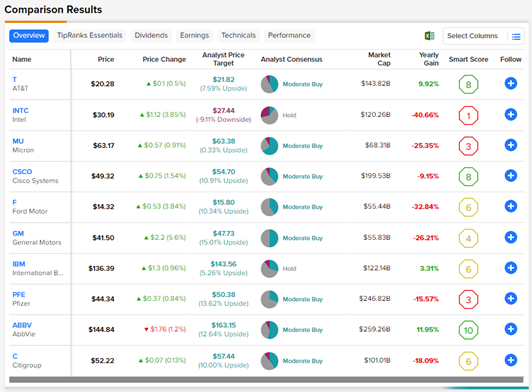

Below is a Screenshot of TipRanks’ Best Value Stocks Comparison

Which Investment Strategy is Better?

It is essential to note that both growth and value investors have the same end goal — to buy low and sell high. In the process, there may be an overlap between the two types of stock investments. During a company’s lifecycle, it can turn from a growth stock to a value stock and vice versa.

Also, not one investing style needs to be an all-time winner over long periods of time. Hence, it could be beneficial if investors applied a “blended” investing style to maximize their portfolio returns. An ideal investment strategy could be to include both growth and value stocks in one’s portfolio. A mix of both would ensure that an investor gets the best of both worlds.

Notably, investors can use TipRanks’ Stock Comparison tool to scan the Best Growth Stocks and Best Value Stocks. Using the tool, investors can also compare and contrast the different parameters of stocks, including analyst price targets, hedge fund signals, blogger opinions, and Smart Scores, to name a few.