The investment environment of 2022 gave investors (especially growth-stock investors) a valuable learning experience. 2022 wasn’t the best year for the stock market, but with careful and thoroughly researched stock selection, investors could have surely added some gems to their portfolio.

Entering 2023, investors can look to growth stocks as an apt investment option. Remarkably, growth investing is usually a long-term, wait-and-watch story. Growth investors generally seek to maximize wealth over a longer time horizon from stock price appreciation and do not pursue short-term gains.

With the S&P 500 index (SPX) finishing 19.44% lower in 2022, a majority of stocks lost significant value, putting them at historically low prices and likely to experience massive future upside potential. Growth stocks, particularly, are very attractive at such low valuations. This brings us to a very important question; which companies fall in the bracket of “growth stocks.”

What are Growth Stocks?

Growth stocks are listed companies that rapidly grow revenue and earnings compared to their peers and the broader overall market. These companies are usually disruptors in their industry and often have the first mover’s advantage.

Additionally, they boast novel technologies and are players in industries that have long-term growth potential. These companies will often hold a leading market position in their sectors and have a large expected TAM (total addressable market). By their very nature, growth stocks can be riskier compared to bigger, well-established companies.

Importantly, growth stocks survive best in low-interest-rate environments where they have the potential to grow their revenues and earnings the fastest. In contrast, these companies will have a limited ability to grow during times of economic downturn and instability. Also, they become unattractive as rising interest rates reduce the value of future cash flows.

Growth stocks are also accompanied by high stock price volatility and high price/earnings (P/E) and price/sales (P/S) ratios. Remarkably, investors price in expectations for future growth, so these stocks trade at relatively expensive multiples and command a premium for their growth potential.

How to Pick the Best Growth Stocks

Here are a few characteristics of growth stocks that could help an investor select the best company to invest in. I will call it “investing” and not “trading” because it is essential to hold on to growth stocks for the long run to earn maximum returns.

- Revenue Growth – Growth stocks should have a rapidly expanding revenue stream. This applies to both historical revenue growth and future expectations of revenue growth.

- Increasing Earnings – Similar to revenue, growth stocks should also see their earnings (profits) expand faster than their competitors. Also, their future earnings potential should be relatively higher than both the sector they operate in and the market in general.

- Return on Equity – Return on Equity (ROE) is defined as net income divided by shareholders’ equity. Look for growth stocks that have a higher ROE than their peers, implying that they’re generating more returns per share for their shareholders.

- Debt-to-Equity Ratio – Growth stocks usually reinvest most of their profits into the business to enhance production. At the same time, they lean on debt to finance operations, thus leading to higher debt. Having said that, investors must look for companies with manageable Debt-to-Equity ratios while selecting growth stocks.

- TAM and Market Share – Finally, select growth stocks that have a large addressable market (TAM) and also possibly a larger piece of the market. Growth stocks operate in industries that have solid long-term market trends and are well-positioned to gain an advantage from them. A company that has made a niche for itself and commands a competitive edge in the sector it operates in can be a good selection.

A suitable example of a growth investor is ace hedge fund manager Cathie Wood. Through her funds, Cathie invests in innovative technology and disruptive growth companies and believes in their long-term success stories. Some of her investments include; electric vehicle maker Tesla (NASDAQ:TSLA), television streaming platform Roku (NASDAQ:ROKU), and cryptocurrency exchange platform Coinbase Global (NASDAQ:COIN).

The Takeaway

Investing in growth stocks can be an opportunity to grow wealth abundantly. At the same time, investors must watch out for any signs of weakness in the financials of the company and make appropriate decisions.

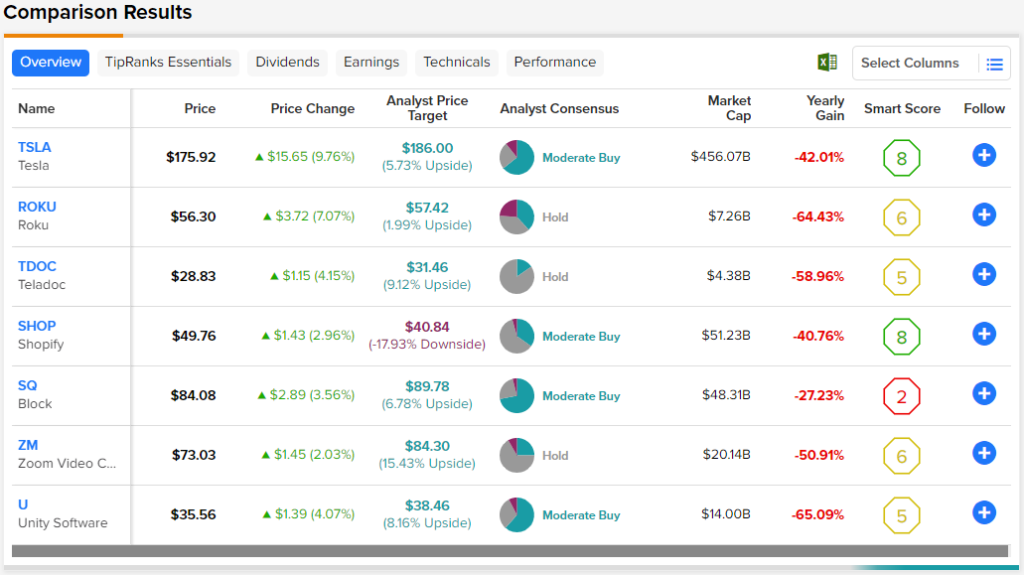

Notably, investors can use TipRanks’ Stock Comparison tool to scan the Best Growth Stocks. Using the tool, investors can also compare and contrast the different parameters of growth stocks, including analyst price targets, hedge fund signals, blogger opinions, and Smart Scores, to name a few.