Shares of Ohio-based retailer The Kroger Co. (KR) gained up to 12.6% on Thursday before closing 11% up after the company reported strong financial results for the third quarter of 2021.

Kroger runs retail food and drug stores, multi-department stores, jewelry stores, and convenience stores in 35 U.S. states and the District of Columbia. Moreover, it operates 35 food processing or manufacturing facilities, 1,605 supermarket fuel centers, 2,254 pharmacies, and 224 The Little Clinic in-store medical clinics.

Q3 Results

Adjusted earnings stood at $0.78 per share, higher than the Street’s estimate of $0.66 per share and the year-ago figure of $0.71 per share.

Total sales increased to $31.9 billion from $29.7 billion reported in the third quarter of 2020 and came in above analysts’ expectations of $31.23 billion.

FIFO gross margin decreased 41 basis points year-over-year due to higher supply chain costs and continued price investments.

The company repurchased $297 million worth of shares during the quarter, taking the total year-to-date repurchases to $1 billion.

Management Comments

The Chairman and CEO of Kroger, Rodney McMullen, said, “Our focus on execution, combined with our continued discipline in balancing investments in our associates and customers with exceptional cost management, and growth in our alternative profit business allowed us to exceed internal expectations and deliver strong sales and earnings growth.”

The CFO at Kroger, Gary Millerchip, said, “Driven by the momentum in our third-quarter results and sustained food at home trends, we are raising our full-year guidance. We now expect our two-year identical sales stack to be in the range of 13.7% to 13.9%. We expect our adjusted net earnings per diluted share to be in the range of $3.40 to $3.50.”

Meanwhile, the Street expects Kroger to report adjusted EPS of $3.34 in 2021. (See Insiders’ Hot Stocks on TipRanks)

Outlook

Further, the company expects operating profit and capital expenditure in the ranges of $4.1 billion to $4.2 billion and $3.1 billion to $3.3 billion, respectively, in 2021.

Wall Street’s Take

After the release of the third-quarter results, Jefferies (JEF) analyst Matthew Fishbein maintained a Hold rating on the stock with a price target of $40 (10.4% downside potential).

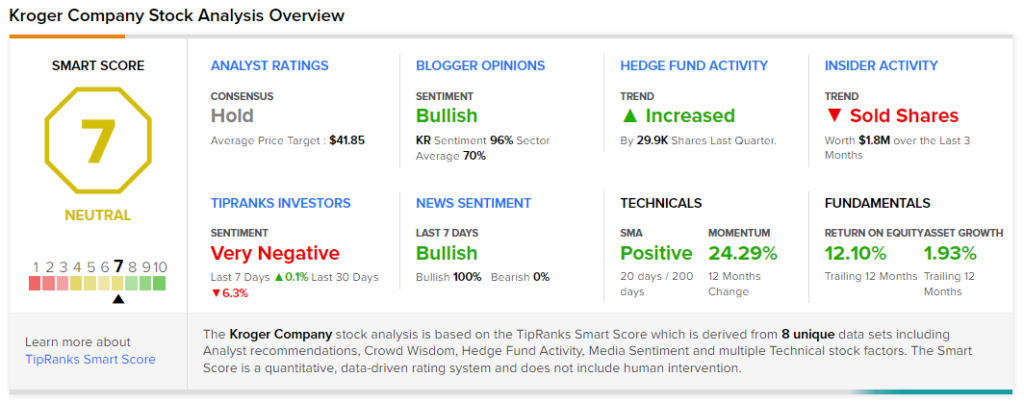

Overall, the stock has a Hold consensus rating based on 2 Buys, 9 Holds and 3 Sells. The average The Kroger Co. price target of $41.85 implies 6.3% downside potential. Shares have gained 44.6% over the past year.

Smart Score

According to TipRanks’ Smart Score rating system, Kroger scores a 7 out of 10, suggesting that the stock is likely to perform in line with market averages.

Related News:

BMO Announces Financial Deal with Boralex

Amphenol Corporation Acquires Halo Technology

Greenbrier Gets New Railcar Orders Worth $670M in Q1; Shares Jump