JPMorgan’s (NYSE:JPM) President and COO Daniel Pinto expects the financial behemoth’s third quarter investment banking fees to decline by 45% to 50% from a year ago. It’s trading vertical, on the other hand, is set to record ~5% gains for the quarter.

Further, Pinto also expects JPM’s lending unit to perform better than earlier expectations, reports Financial Times.

The top honcho displayed restraint when it comes to headcount reductions saying, “You need to be very careful when you have a bit of a downturn, to start cutting bankers here and there, because you will hurt the possibility for growth going forward.”

The development comes as recession worries, and rising prices impact the economy leading to lower fees for banks. This week, Goldman Sachs (NYSE:GS) too, said it could axe a number of jobs amid this trend.

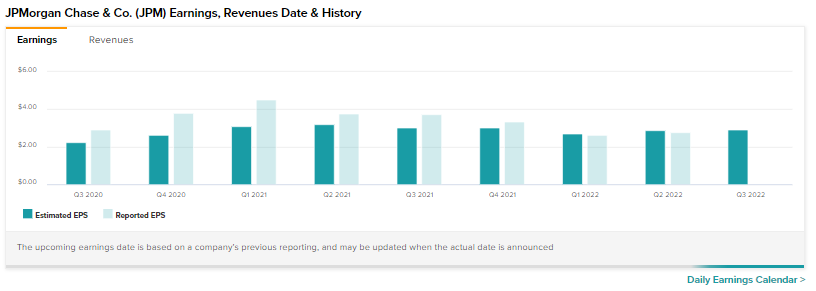

JPM is set to report its third-quarter numbers on October 14. The Street anticipates the bank to post an EPS of $2.92 for the quarter.

In the year-ago period, JPM had delivered an EPS of $3.74 beating expectations of $3.

Read full Disclosure