JPMorgan (JPM) just signed a 13-year carbon credit deal with Canadian startup CO280, locking in rights to 450,000 metric tons of carbon credits for under $200 per ton. That adds up to nearly $90 million and positions the bank as a heavyweight player in the rapidly evolving carbon markets. But this isn’t just a green PR play. JPM wants to be the go-to Wall Street name for companies looking to decarbonize—and profit while doing it.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

CO280 plans to trap and liquefy carbon emissions from a paper mill on the U.S. Gulf Coast, then shoot it through a 35-mile pipeline into underground storage. It’s a rare project for the pulp and paper sector, which typically burns off “black liquor” to power operations—releasing tons of carbon in the process.

JPMorgan Sees Profit in Playing Carbon Market Middleman

This isn’t JPMorgan’s first foray into the carbon world. The bank previously signed a nonbinding agreement with CO280 and invested over $200 million in carbon credits from various sources. Now, it’s locking in supply.

“This is a multi-billion-dollar opportunity for the U.S. forest products industry,” JPMorgan Chief Risk Officer Ashley Bacon told Barron’s. He added that the ability to sell credits could fuel mill upgrades and job creation.

Internally, JPMorgan’s team sees its carbon credit buying as a strategic advantage. “It’s given us the chance to build relationships and expertise,” said Taylor Wright, head of operational decarbonization. That expertise is already paying dividends. Microsoft is buying 3.7 million tons of CO280 credits, and JPM says it’s advising others too.

CO280 Faces Construction Risks and Tax Credit Uncertainty

There’s still a lot that could go sideways. CO280 hasn’t yet built the capture infrastructure. Tax credits worth $85 per ton could help—but they’re now under review in Congress. CEO Jonathan Rhone told Barron’s the credits are “vitally important” but not essential, and says the company is in talks with over 50 other buyers.

Carbon Market Volatility Still Clouds JPMorgan’s Bet

The voluntary carbon market remains murky. Prices swing wildly. Quality is tough to verify. And previous scandals around inflated or fake offsets have scared off some buyers. JPMorgan is betting that tighter standards and scale will clean that up. “There are questions about quality and impact,” Wright admitted, “but not to say you can’t find high-quality credits at a good price.”

JPMorgan’s green ambitions come at a time when U.S. corporations are walking back sustainability goals under the Trump administration. But JPMorgan’s strategy is crystal: make money financing fossil fuels and carbon reduction—and be the best advisor in both.

Is JPMorgan a Good Stock to Buy?

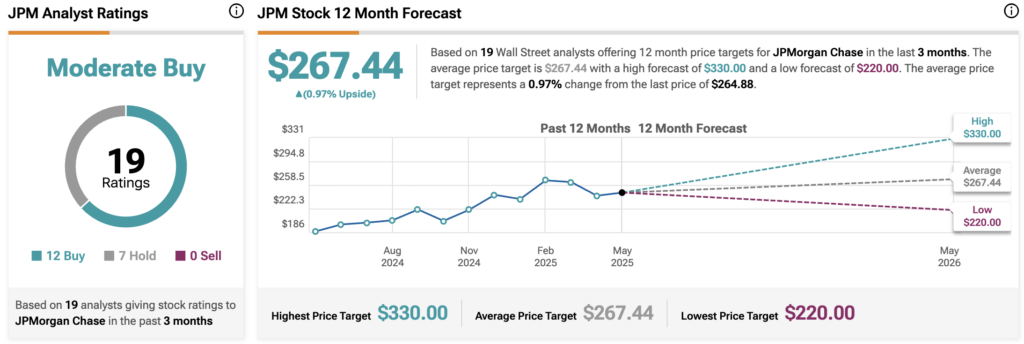

According to TipRanks, JPMorgan Chase (JPM) carries a Moderate Buy consensus rating from 19 Wall Street analysts. Out of those, 12 rate the stock a Buy and seven call it a Hold, with zero Sell ratings.

The average 12-month JPM price target is $267.44, representing just a 0.97% upside from the latest close at $264.88. The highest target sits at $330, while the lowest forecast comes in at $220.