JPMorgan Chase (NYSE:JPM) is on the front page of the financial headlines right now. Short-term stock traders are running for the exits – but that’s good news for value seekers. However, if you can’t accept uncertainty, you might miss out on a chance to invest in a banking behemoth with solid financial results. After delving into the company’s actual data instead of joining the fearful crowds, I am 100% bullish on JPM stock.

JPMorgan Chase, often referred to as just JPMorgan, is so big that it actually rescues smaller, troubled banks from time to time. The company’s CEO, Jamie Dimon, is well-respected among banking sector executives.

Sure, the prospect of higher-for-longer interest-rate policy is real and can’t just be overlooked. Nevertheless, JPMorgan should be able to withstand banking sector pressures while offering a package of value and yield to patient investors.

JPM Stock: Collect Dividends, Reinvest — Rinse and Repeat

Not surprisingly, holding JPM stock is much like putting your money in the bank and collecting periodic interest payments. If you have a long-term plan and are willing to reinvest JPMorgan Chase’s quarterly dividend payouts, you can build substantial wealth over time.

If JPMorgan continues to pay $1.15 per quarter (which isn’t guaranteed but seems plausible) or $4.60 per year, and assuming a current share price of $184, the forward annualized dividend yield comes out to 2.5%. This would beat the financial sector’s average annual dividend yield of 2.114%, so passive-income investors should be pleased with that.

What about value seekers? They can also have a favorable view of JPMorgan, as the company doesn’t appear to be overvalued at all.

Again, a good old calculator comes in handy here, along with TipRanks’ earnings page for JPMorgan Chase. It didn’t take long to figure out that JPMorgan earned $16.56 per share during the past four quarters. If we again assume a share price of $184, then JPMorgan’s trailing price-to-earnings (P/E) ratio would be $184 divided by $16.56, or 11.1x.

That’s quite similar to JPMorgan’s five-year average non-GAAP trailing P/E ratio of 11.04x. The point is that JPMorgan has offered a compelling value-and-dividends combo for a long time. Will today’s share-price drop change your outlook on the company, though?

Don’t Lose Sleep Over “Uncertain Forces”

JPM stock is down 5.6% today, but it wasn’t because JPMorgan Chase produced poor earnings results. Actually, the company’s data look pretty good. Mainly, the market is worried about high interest rates and Dimon’s warning about “a number of significant uncertain forces.”

There really are no big surprises here. The market already knows about the “uncertain forces” that Dimon is citing: “terrible wars and violence,” “geopolitical tensions,” “persistent inflationary pressures,” and “quantitative tightening.”

Sure, you can hoard cash and hide out in a bunker if you’re really worried about these issues. Alternatively, you can take advantage of the panic selling that’s happening today with JPMorgan stock.

Personally, I’m choosing to stick to the known data and stay out of the bunker. In 2024’s first quarter, JPMorgan generated revenue of $42 billion, which was in line with the consensus estimate. This result also demonstrates improvement over the $38 billion in revenue that JPMorgan reported in the year-earlier quarter.

Turning to the bottom-line results for Q1 of 2024, JPMorgan earned $4.44 per share, easily surpassing Wall Street’s consensus call for $4.17 per share. All in all, I’d say Dimon and JPMorgan had a good quarter despite “geopolitical tensions,” “persistent inflationary pressures,” and so on.

Frankly, I get excited when the market’s initial reaction is unreasonable. This morning, I saw a Wall Street Journal headline that read, “JPMorgan Stock Slides, Despite Jump in Earnings.” That’s precisely the type of opportunity that I like to pounce on.

Sure, Dimon’s dire warning will alarm some jittery investors. Bear in mind, though, that JPMorgan Chase isn’t a small banking start-up. It’s the world’s fifth-largest bank and has survived through “geopolitical tensions,” “quantitative tightening,” and much more. So, I would personally relax and enjoy the quarterly dividend distributions.

Is JPM Stock a Buy, According to Analysts?

On TipRanks, JPM comes in as a Moderate Buy based on 17 Buys and six Hold ratings assigned by analysts in the past three months. The average JPMorgan Chase stock price target is $203.80, implying 10.8% upside potential.

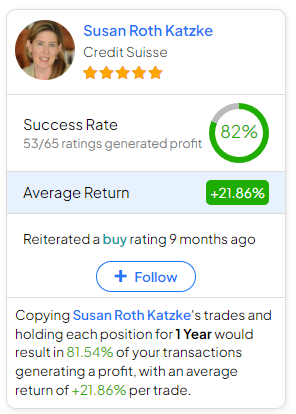

If you’re wondering which analyst you should follow if you want to buy and sell JPM stock, the most accurate analyst covering the stock (on a one-year timeframe) is Susan Roth Katzke of Credit Suisse, with an average return of 21.86% per rating and an 82% success rate. Click on the image below to learn more.

Conclusion: Should You Consider JPM Stock?

Dimon and JPMorgan Chase are foundational to the U.S. banking system. They’re not going away anytime soon. It’s fine to acknowledge the risks that Dimon cited, but occasional share-price dips in JPMorgan stock should be cheered, not feared.

I’m confident that JPMorgan Chase will continue to reward its shareholders with consistent dividend payments while providing good value. Consequently, I encourage you to conduct your due diligence on JPMorgan, and I am considering JPM stock with the utmost confidence.