The U.S. banking system’s biggest operators are all due to report quarterly earnings over the next month, as “earnings season” draws near. The biggest bank by market capitalization, J.P. Morgan Chase (JPM), is set to report its Q3 results on October 14 before the opening bell. Notably, four other heavy hitters, Wells Fargo (WFC), BlackRock (BLK), Goldman Sachs (GS), and Citigroup (C), are also due to publish quarterly reports the same morning.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Momentum in JPM’s shares has been extremely bullish—JPM has significantly outperformed the broader market over the past twelve months and throughout this year, posting a 29% gain so far—almost reaching the exclusive club of companies with a market value above $1 trillion.

However, this bull run has been accompanied by multiple expansion. JPM is now trading at historically high valuations, which raises the pressure to overdeliver—especially in a market that is already highly optimistic about the bank’s growth.

In my view, this sets up a meaningful short-term risk of correction. With potential headwinds in the Consumer & Community Banking segment and a close eye on credit quality in the current macro environment, I prefer to stay on the sidelines in the near term and maintain a Hold rating, primarily because valuations leave little room for error.

The Forces Behind J.P. Morgan’s Momentum

At the current juncture, I would break down J.P. Morgan’s recent bullish trajectory into a few key drivers, which have been behind the upward revisions to the bank’s top and bottom lines.

First, regulation. There’s a strong market expectation that Washington will revise or soften the current Basel III Endgame proposal, which essentially would reduce the amount of high-quality capital (CET1) required per dollar of risk-weighted assets. For context, regulators currently require a 12.3% CET1 ratio, whereas J.P. Morgan’s ratio is 15.1%. If rules are eased toward ~11%, the bank could free up some “idle” capital, automatically boosting profitability—improving ROE/ROTCE, loan growth potential, and net interest margins.

Second, there are rate cuts. With the Fed cutting rates to 4.25% in September and hints of two more cuts by year-end, households are expected to have more disposable income. That money flows into the banking system, and as the largest U.S. bank, J.P. Morgan is positioned to capture a disproportionate share of new, low-cost deposits—enhancing its funding mix and driving profitability.

Third is balance sheet strength. J.P. Morgan’s conservative risk management has resulted in a robust balance sheet, holding $393.7 billion in cash and equivalents (about 46% of its market cap) and a significant amount of short-duration Treasuries as a liquidity reserve. This provides a significant defensive advantage in downturns compared to its peers.

Last but not least is record-high profitability. J.P. Morgan’s return on tangible common equity (ROTCE) sits at 21%, a multi-decade high virtually tied with September 2021, and the trend appears set to continue. Strong fundamentals, combined with favorable market sentiment, clearly support the recent bullish outlook.

J.P. Morgan Faces Heightened Expectations In Q3

As J.P. Morgan prepares to report its September-quarter results, the story is different from last quarter: the bank now faces a much higher bar after robustly outperforming the low expectations in Q2.

EPS expectations for Q3 are $4.83 (normalized estimate)—a 10.5% year-over-year increase—but this also implies bottom-line numbers roughly 8% above estimates from two quarters ago, with much of that already priced into the recent rally. As a result, tough comps could become a challenge for JPM at this juncture.

Part of the pressure comes from valuation. J.P. Morgan trades at 3x its tangible book value—the highest in two decades—and at 15.9x earnings, the top among its main peers and 30% above its five-year average. As a rule of thumb, premium stocks must deliver—or even overdeliver—to keep moving higher.

Even minor signs of a slowdown, whether in Corporate & Investment Bank, Markets, or Consumer & Community Banking revenues, could weigh on the stock, given that the market is already pricing in excellent performance.

Other Factors That Could Move the Needle for JPM

Furthermore, I would dive deeper into the key topics likely to dominate Q3 earnings day. On the Consumer & Community Banking side, momentum in mortgage and auto lending looks cautiously optimistic heading into Q3. In Q2 2025, mortgage production reached $11.2 billion—a slight 2% decline year-over-year but a modest 2% increase quarter-over-quarter—suggesting that while overall demand may be softening, recent activity shows signs of stabilization, which is a positive signal.

Auto loan and lease originations paint an even stronger picture, rising 6% YoY and 1% QoQ to $8.7 billion. Overall, these figures suggest that consumer appetite for big-ticket financing hasn’t waned yet, potentially supported by favorable interest rates or robust credit availability.

The caveat is the marginal dip in mortgage volume compared to last year, which could signal that housing demand is plateauing. Q3 will be pivotal in determining whether this is a temporary lull or the start of a broader slowdown.

On the credit quality front, emerging stress is visible, particularly in Card Services. Credit costs surged to $2.1 billion in Q2—a staggering 272% increase from the prior year—driven primarily by higher credit card losses. This suggests consumer strain is becoming more apparent in unsecured credit.

Interestingly, the change in the allowance for credit losses was minimal at $6 million, implying that management may not yet see this as a systemic issue. Regardless, the Card Services line will be an essential metric to watch in Q3, as it could signal broader credit fatigue in the second half of 2025.

Is JPM a Buy, Hold, or Sell?

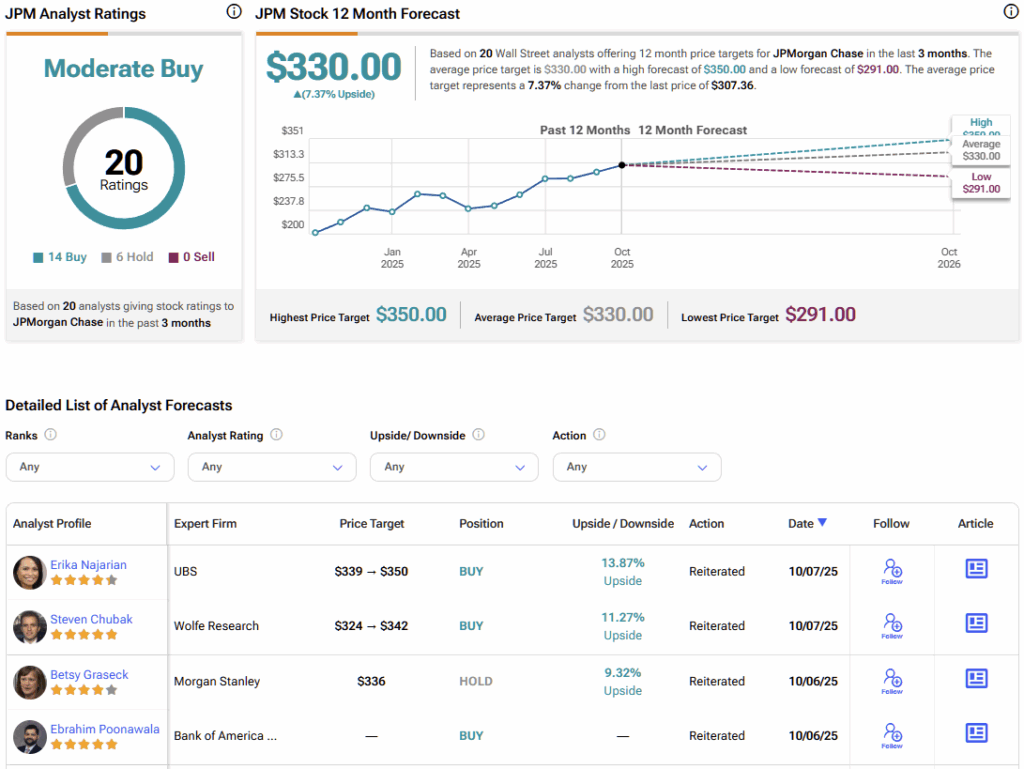

Wall Street’s consensus on JPMorgan remains moderately bullish. Of 20 analyst ratings issued over the past three months, 14 are bullish and six are neutral—none bearish. JPM’s average stock price target of $330 suggests a potential upside of about 7% from current levels.

JPM Near-Term Outlook Clouded by Valuations

J.P. Morgan is currently the priciest stock among top U.S. incumbent banks, driven by high expectations for profitability growth and the potential to outperform its peers. This makes it possible that Q3 could bring tough comps after a Q2 that far exceeded expectations, which helped fuel its recent rally (though this isn’t necessarily true for all banking segments).

While elevated valuations could act as a short-term drag on performance, I don’t see this as the time to shy away entirely. JPM’s high-quality balance sheet and conservative management make it the most defensively positioned among major U.S. banks. That said, I would take a Hold stance in the near term, purely from a valuation perspective. Owning JPM still makes sense over the long run, but I expect that reaching a trillion-dollar market cap isn’t a given under these conditions.