Shares of multinational healthcare giant Johnson & Johnson (NYSE: JNJ) closed nearly 3% higher on Tuesday despite the company’s fourth-quarter sales results falling short of expectations.

Adjusted EPS increased 14.5% year-over-year to $2.13, coming in just above the Street’s estimate of $2.12.

Sales grew 10.4% year-over-year to $24.8 billion, missing analyst expectations of $25.29 billion.

The Consumer Health segment’s sales rose 1.1% to $3.7 billion, Pharmaceutical segment sales jumped 16.5% to $14.3 billion, and the Medical Devices segment’s sales climbed 4.1% to $6.9 billion.

JNJ CEO Joaquin Duato said, “Given our strong results, financial profile, and innovative pipeline we are well-positioned for success in 2022 and beyond.”

Guidance

Along with the fourth-quarter results, the company also provided guidance for full-year 2022. It expects sales to range from $98.9 billion to $100.4 billion and adjusted EPS to lie between $10.40 and $10.60.

Consensus estimates for sales and EPS stand at $97.88 billion and $10.37, respectively.

About Johnson & Johnson

New Jersey-based Johnson & Johnson produces and sells medical devices, pharmaceuticals, and consumer health products. Its brands include Band-Aid, Johnson’s Baby, Tylenol, Neutrogena, Clean & Clear, and Acuvue, among others.

JNJ stock is listed on the Dow Jones Industrial Average (DJIA).

Wall Street’s Take

Following the release of the results, Citigroup analyst Joanne Wuensch reiterated a Buy rating on the stock with a $195 price target (16.3% upside potential).

In a research note to investors, the analyst said, “Against a challenging backdrop JNJ delivered a quarter that reflected resilience and gave 2022 guidance that bracketed consensus.”

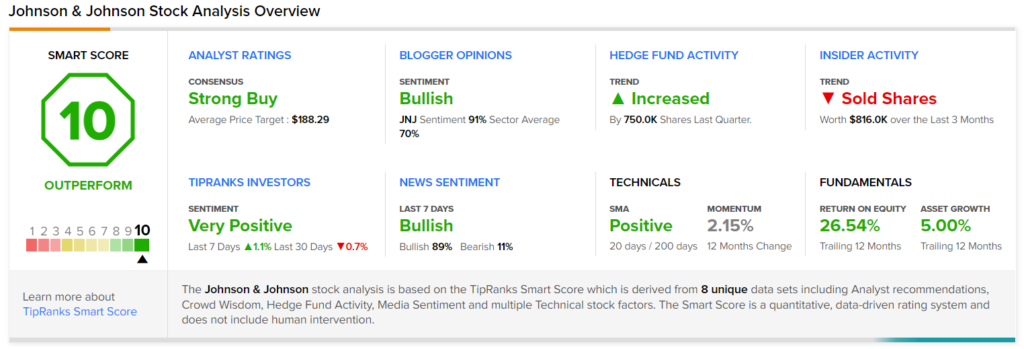

Overall, the stock has a Strong Buy consensus rating based on 6 Buys and 2 Holds. The average JNJ price forecast of $188.29 implies 12.3% upside potential. Shares have gained 2.4% over the past year.

Smart Score

Johnson & Johnson scores a “Perfect 10” on TipRanks’ Smart Score rating system. This implies that the stock has strong potential to outperform market expectations, making it one of the best growth stocks for 2022.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Galiano Gold Announces Results for Asanko Gold Mine

J.P. Morgan To Acquire 49% Stake In Viva Wallet

NVIDIA Does Not Expect Arm Acquisition to Close — Report