Ride-hailing firm Uber Technologies (UBER) is set to release its Q3 earnings report this week. This has some investors wondering whether it’s a good idea to buy shares of UBER stock beforehand.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What Wall Street Expects

Wall Street is expecting UBER to announce quarterly earnings of 67 cents per share, which would indicate a 44.2% decline from the same period last year. Its revenues are forecast to come in at $8.55 billion, up 27.2% from a year ago.

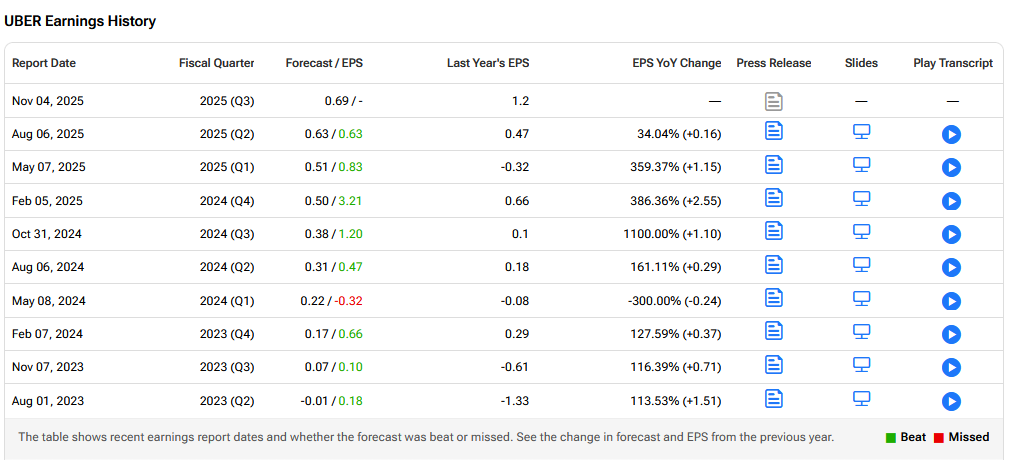

Will UBER be able to beat these estimates? As one can see below, it has a very strong track record of doing just that in recent times.

What Do Analysts Say?

In the second quarter of 2025, Uber achieved a notable increase in trips and gross bookings, both growing by 18% year-over-year. The company reported an income from operations of $1.5 billion and an adjusted EBITDA of $2.1 billion, marking a 35% increase compared to the previous year. Uber’s operating cash flow reached $2.6 billion, with free cash flow at $2.5 billion.

Uber anticipates continued growth in the third quarter of 2025, with projected gross bookings between $48.25 billion and $49.75 billion, representing a 17% to 21% year-over-year increase.

However, tariff-related headwinds are likely to hurt its results. The company also recently flagged up profitability issues in the U.K. as a result of higher administration costs and a hike in overall spending.

UBS likes what it sees. It recently raised its price target on Uber to $124 from $117 with a Buy rating. It said that food delivery demand remains resilient post-COVID, with convenience driving stronger-than-expected stickiness and medium-term growth. It warned however of more intense competition from Deliveroo and Amazon (AMZN) as it expands same-day grocery delivery. It adds that slower robotaxi adoption gives Uber more room to grow profits in the near-term.

Guggenheim analyst Taylor Manley initiated coverage of UBER with a Buy rating and $140 price target. He said UBER has an “industry-leading” network, technology, and brand equity, Uber’s re-accelerating delivery business is also relatively overlooked by investors, Manley said, and poised for sustainable double-digit growth.

Is UBER a Good Stock to Buy Now?

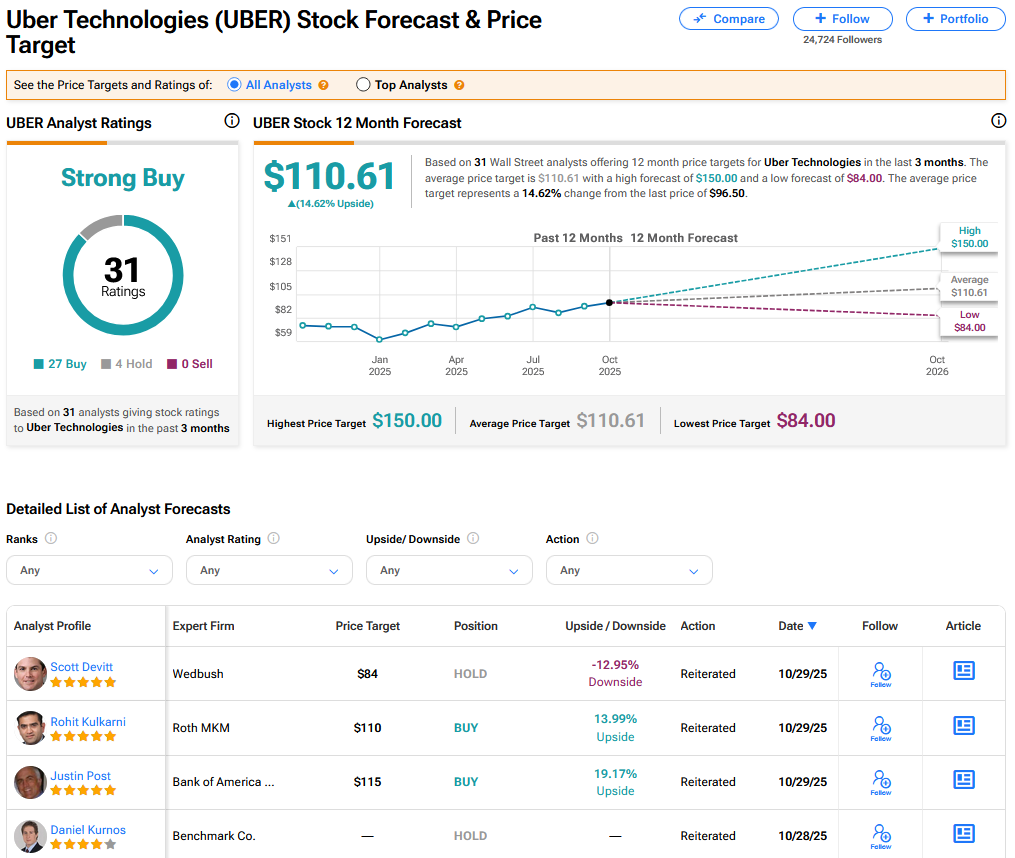

On TipRanks, UBER has a Strong Buy consensus based on 27 Buy and 4 Hold ratings. Its highest price target is $150. UBER stock’s consensus price target is $110.61 implying a 14.62% upside.