Sportswear giant Nike (NKE) is set to release its Q1 earnings report next week. This has some investors wondering whether it’s a good idea to buy shares of NKE stock beforehand.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What Wall Street Expects

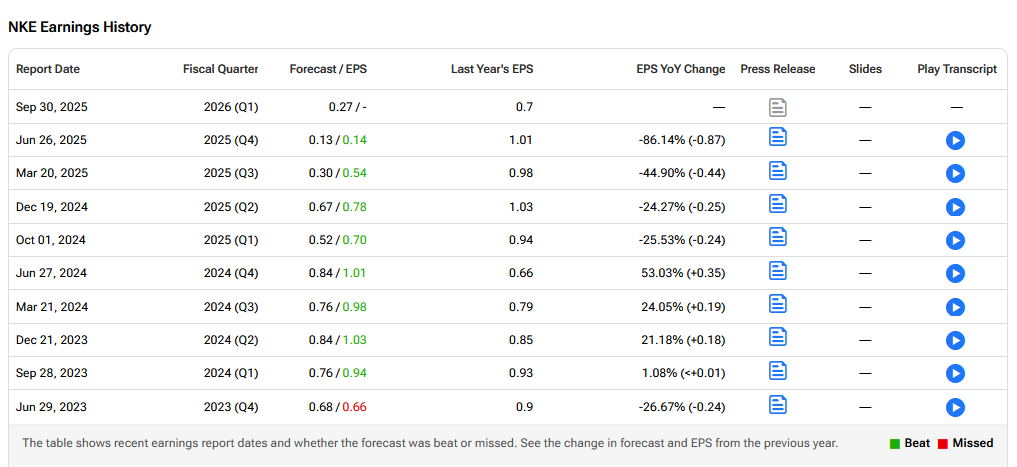

Wall Street is expecting NKE to report quarterly earnings of $0.27 compared with $0.70 in the same period last year. Revenues are expected to come in at $11 billion, down 5% year-on-year.

Will NKE be able to beat these estimates? As one can see below, it has a very strong track record of doing just that in recent times.

Key Issues Ahead of Earnings

Nike has suffered a 25% slide in its share price in the last 12 months. It’s been hampered by strategic mishaps, particularly online, tougher competition, President Trump’s tariffs and volatile consumer confidence.

“Nike hasn’t been performing anywhere near its peak. There has been an onslaught of newer, trendier, more exciting sportswear brands entering the market covering apparel and footwear that have created a major headache for the world’s largest sportswear brand,” said Victoria Scholar, head of investment at interactive investor. “Nike became a bit complacent at the top and is now having to do some soul searching to try to reignite its spark with a renewed focus on sports, cost cuts, and innovations.”

As part of this shift, Nike announced a tie-up with Kim Kardashian’s Skims, harnessing her immense social media power to try to improve engagement with female shoppers. Although its launch has been mired by production issues.

In Q4 it reported a sharp drop in quarterly net income to $211 million versus $1.5 billion year-on-year while sales slumped 12% to $11.1 billion. However, shares soared by over 15% on that day thanks to investor optimism towards its turnaround plan. Nike’s CFO Matthew Friend said he expected “headwinds to moderate from here.”

Earlier this week one of its key customers JD Sports said that Nike’s new chief executive Elliott Hill was – in the very best Nike language – “doing all the right things.”

Ahead of the results, RBC Capital Markets analyst Piral Dadhania upgraded Nike to Buy from Neutral and raised the price target to $90 from $76. He said Nike’s sales should recover more quickly than many on Wall Street expect, helped by new products and the commercial lift from the FIFA World Cup next year.

Is NKE a Good Stock to Buy Now?

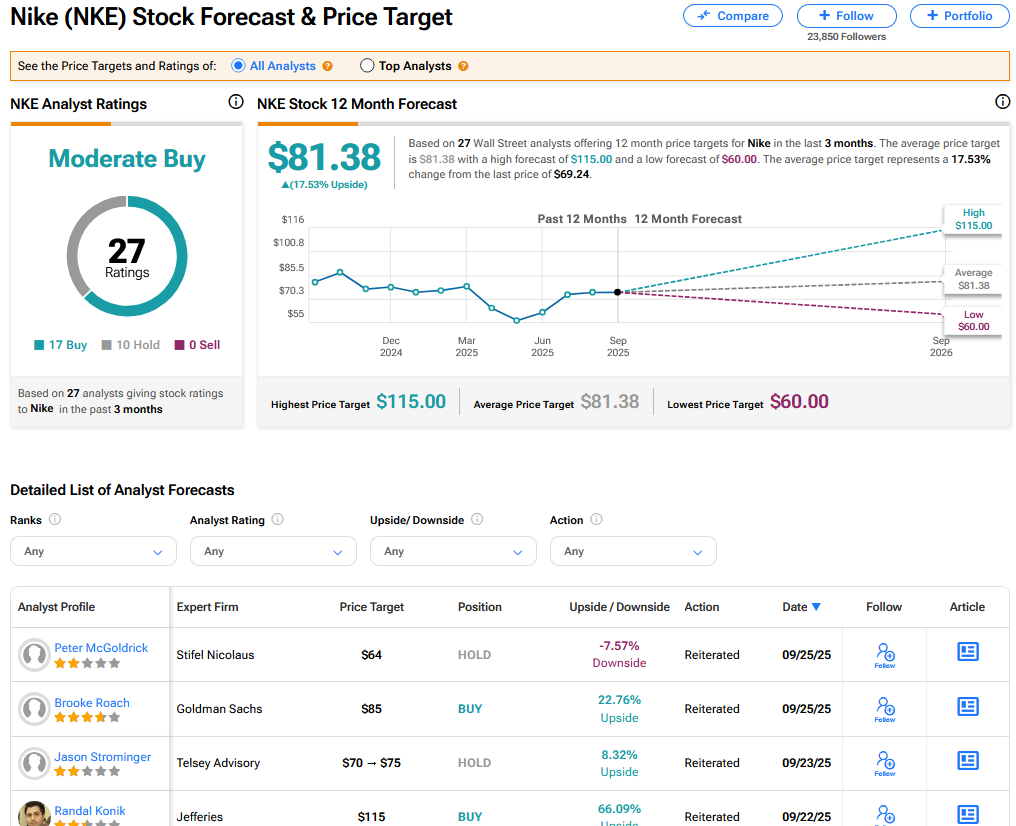

On TipRanks, NKE has a Moderate Buy consensus based on 17 Buy and 10 Hold ratings. Its highest price target is $115. NKE stock’s consensus price target is $81.38, implying a 17.53% upside.