Shares in sportswear giant Nike (NKE) were looking less lively today after one of its largest customers said it was on the right track to lift customer demand.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

British Backing

U.K.- based sports retailer JD Sports said that Nike’s new chief executive Elliott Hill was – in the very best Nike language – “doing all the right things.”

His comments are important because Nike products make up about 45% of JD Sports’ sales.

“We think Nike are doing all the right things in terms of resetting the business,” said Dominic Platt, JD Sports’ chief financial officer.

Platt said new products from Nike were “resonating well” with customers, highlighting the Vomero, Pegasus and P-6000 running ranges.

However, more worryingly for JD and for Nike, it reported that group like-for-like sales dropped by 2.5% to £5.94 billion over the 26 weeks to August 2. It said like-for-like sales dropped by 3.8% in its key North American arm and were down 3.3% in the UK. However, total sales grew by 18%.

Tired Youth

“A weak economic backdrop is not helpful and while the youthful demographic targeted by the sportswear chain may not be weighed down by costs like servicing a mortgage or nursery fees, they still have less money in their pockets,” said AJ Bell investment director Russ Mould. “A greater risk might be a waning of the athleisure trend which saw people wearing the same outfits for the gym, relaxing at home and socialising.”

Hill, who was with Nike for more than three decades, returned as CEO in October to lead a turnaround at the firm which had been struggling with strategy missteps that soured its relations with retailers.

Under Hill, Nike has been investing in its running shoe and sneaker lines to reclaim lost ground in the segments, while rekindling relationships with retailers.

Indeed, it has implemented what it calls Win Now actions and a sport offense realignment to reposition its brands and business for future growth. This includes a focus on sport-obsessed teams to drive innovation and growth across NIKE, Jordan, and Converse brands.

It has also announced a new partnership with Amazon (AMZN) to carry a select assortment of footwear, clothes and accessories.

However, its share price has continued to struggle, falling 4% since the start of the year – see above. The company reports Q1 earnings later this month and expects revenues to decline by mid-single digits due to ‘ongoing inventory liquidation and digital traffic challenges.’

Is NKE a Good Stock to Buy Now?

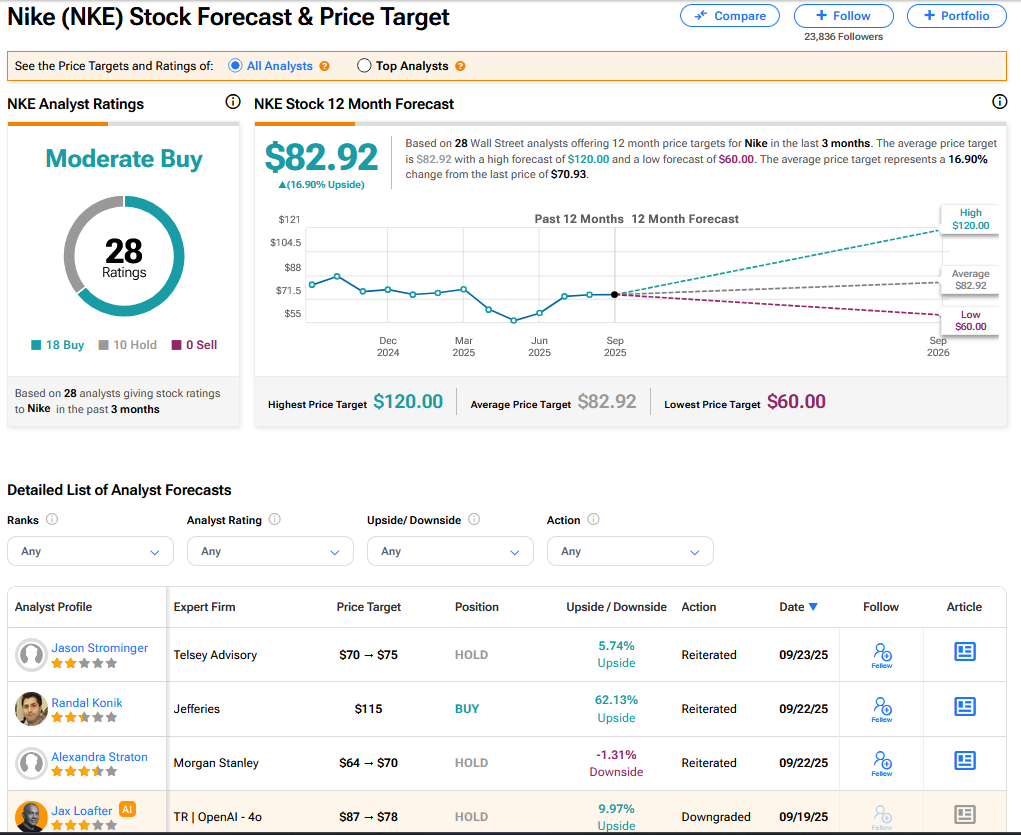

On TipRanks, NKE has a Moderate Buy consensus based on 18 Buy and 10 Hold ratings. Its highest price target is $120. NKE stock’s consensus price target is $82.92, implying a 16.90% upside.