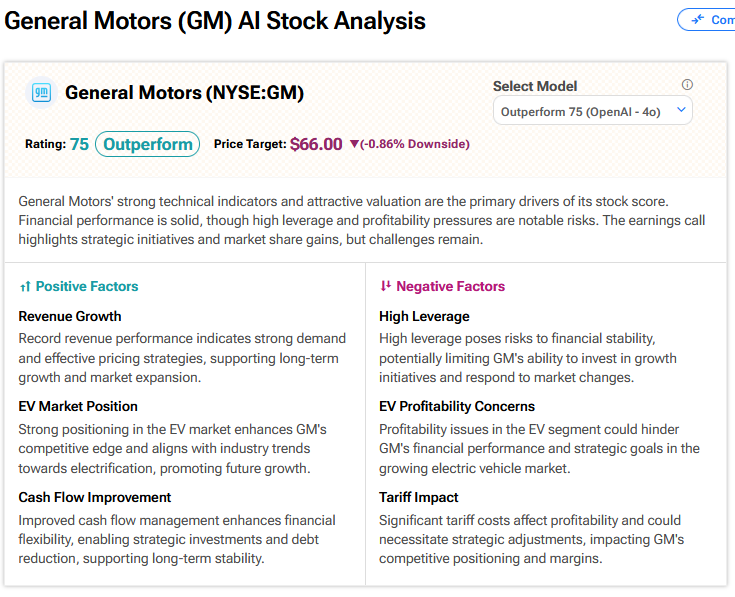

General Motors (GM), which reported strong Q3 earnings earlier this week, has earned an Outperform rating from TipRanks’ A.I. Stock Analysis tool.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For context, TipRanks’ A.I. Stock Analysis provides automated, data-backed evaluations of stocks across key metrics, offering users a clear and concise view of a stock’s potential.

The tool assigns an Outperform rating on General Motors stock with a solid score of 75. Meanwhile, the A.I. analyst assigns a price target of $66 to GM stock, implying a downside of 0.86% from the current levels.

Attractive Valuation

Our AI analyst said that General Motors’ strong technical indicators and attractive valuation of $55.12 billion are the primary drivers of its stock score. Financial performance is solid, though high leverage and profitability pressures are notable risks. The Q3 earnings call also highlighted strategic initiatives and market share gains.

Our AI guru said GM’s record revenue performance indicates strong demand and effective pricing strategies, supporting long-term growth and market expansion. It added that its strong positioning in the EV market enhances GM’s competitive edge and aligns with industry trends towards electrification, promoting future growth.

Finally, it said that improved cash flow management enhances financial flexibility, enabling strategic investments and debt reduction, supporting long-term stability.

As can be seen above, there are still some barriers ahead for GM. Our AI analyst pointed out the company’s high leverage and concerns around profitability in its EV segment.

Despite some more positive signs on the tariffs front, our analyst is still cautious. It warned that tariffs could still impact the company’s margins and strategy.

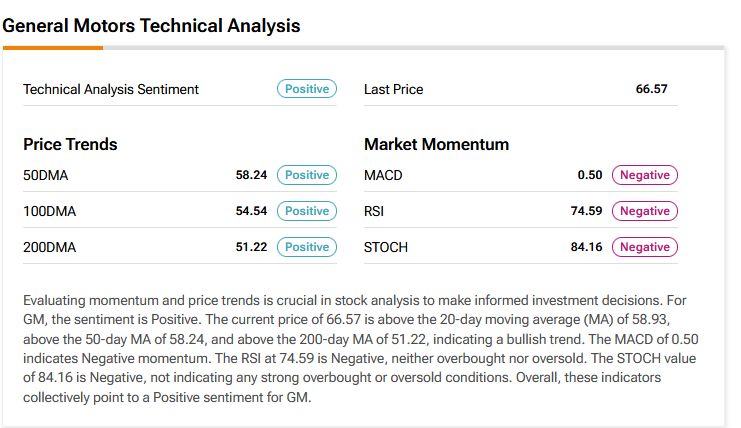

Technical Analysis

As can be seen above, technical indicators are mixed. Market momentum looks particularly concerning.

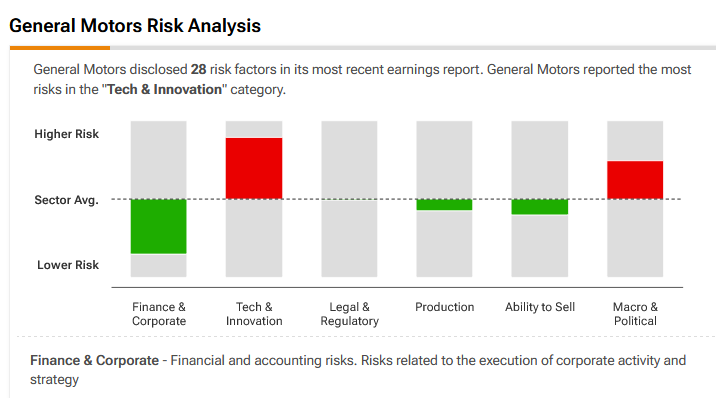

Other risks investors need to be aware of when considering putting cash into GM stock include Tech & Innovation and Macro/Political.

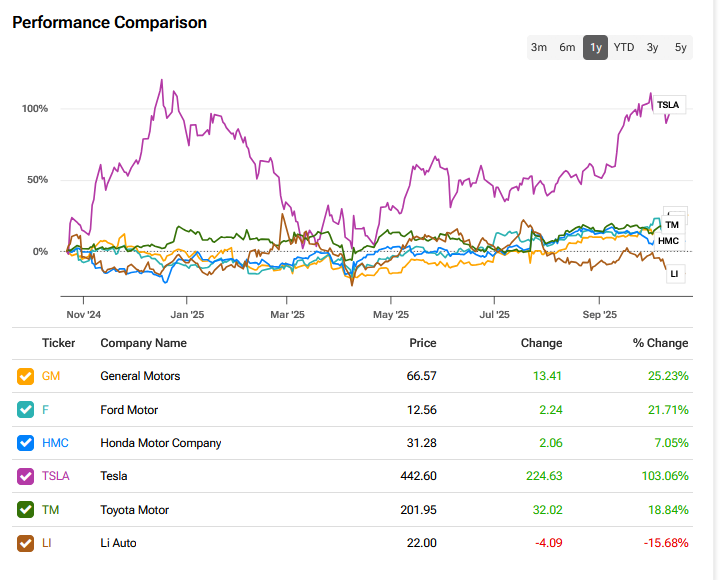

How Does GM Compare with its Peers?

Let’s look at how GM compares with its motoring peers. As can be seen below the stock is trailing only EV-making rival Tesla (TSLA).