U.S. auto replacement parts and accessories group AutoZone (AZO) is set to release its Q4 earnings report this week. This has some investors wondering whether it’s a good idea to get behind the wheel and buy shares in the company beforehand.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

What Wall Street Expects

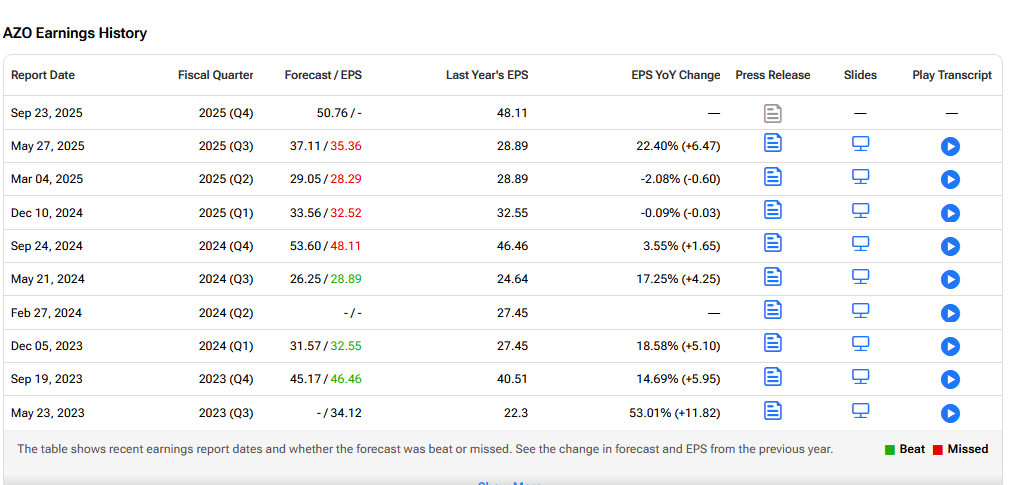

Wall Street is expecting AZO to report Q4 earnings of $51.13 per share, which would mark a year-over-year increase of 6.3%. Revenues for the period are set to come in at $6.24 billion, reflecting an increase of 0.6% compared with the same period last year.

Will AZO be able to beat these estimates? As one can see below, it has a fairly mixed track record in beating expectations.

Key Issues Ahead of Earnings

In Q3 the company reported a 5.4% growth in total sales, reaching $4.5 billion, while domestic same-store sales improved by 5%, and international constant currency comps increased by 8.1%. However, earnings per share decreased by 3.6%, impacted by foreign exchange headwinds given the stronger U.S. dollar.

AutoZone opened 54 new domestic stores and 30 international stores during the period as part of its continued expansion plans.

The AutoZone business model tends to do well during times of economic and consumer uncertainty. When it comes to cars, drivers, during tough periods, tend to prefer to repair existing cars rather than splashing out on new models. President Trump’s tariffs are also unlikley to materially impact the business, even if it sources parts from China, Mexico and Canada -all hit by higher rates.

Again, that’s because if a person’s car needs an urgent repair then price increases are unlikely to deter them from just getting the job done and getting back on the road.

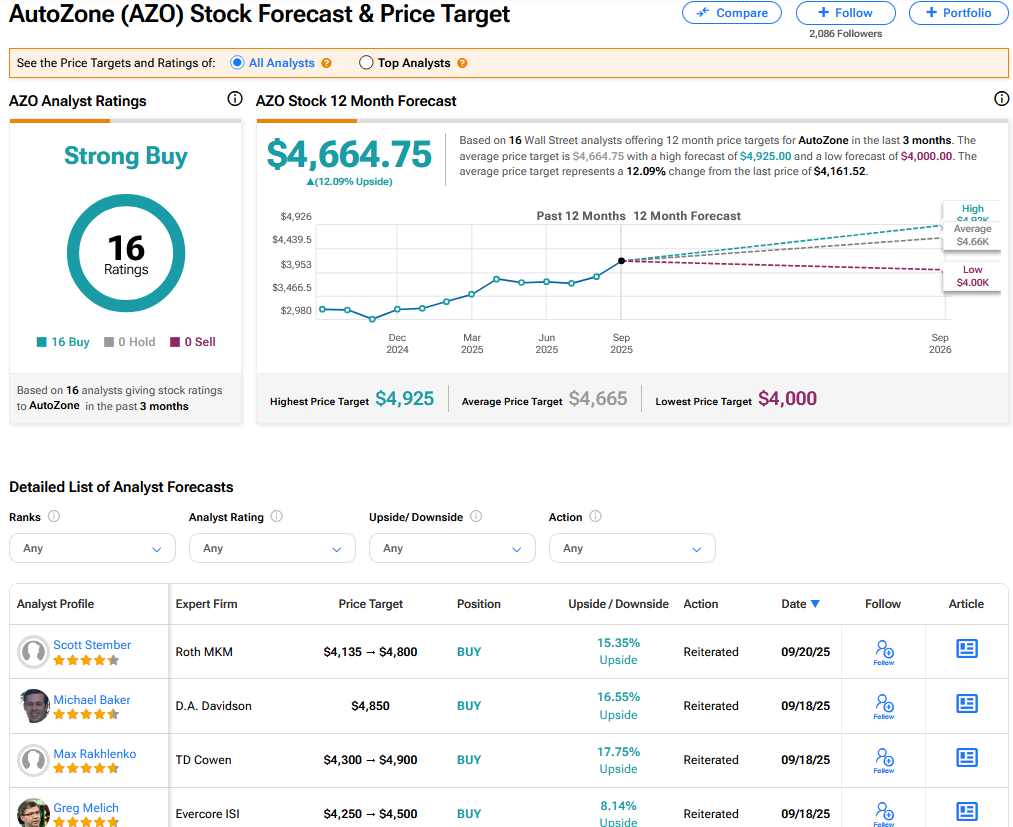

Indeed, the “durability” of AZO’s business model and the “mission-critical nature of end demand” recently persuaded Roth Capital analyst Scott Stember to raise his price target on the stock to $4,800 from $4,135. He has a Buy rating on AZO.

Evercore ISI analyst Greg Melich raised his price target on AutoZone to $4,500 from $4,250 and kept a Buy rating. Expectations are “high but justified,” he said, citing do-it-for-me initiatives. He said that AutoZone is poised to gain share in “a reenergized auto aftermarket landscape.”

Is AZO a Good Stock to Buy Now?

On TipRanks, AZO has a Strong Buy consensus based on 16 Buy ratings. Its highest price target is $4,925. AZO stock’s consensus price target is $4,664.75, implying a 12.18% upside.