Grocery delivery company Instacart raised its initial public offering (IPO) price from a range of $26 to $28 to a range of $28 and $30 per share. The company raised its price target following the IPO success of British chip designer Arm Holdings (NASDAQ:ARM).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

After including stock options and restricted stock units, Instacart’s total valuation is now in the range of $9.3 billion to $9.9 billion, higher than its earlier valuation of $8.6 billion to $9.3 billion. The raised valuation is still way below the $39 billion level the company saw in its last funding round in 2021.

Instacart is expected to list next week under the stock symbol “CART.” The company expects to receive $550.5 million in net proceeds from this offering and the private placement of Series A Preferred Stock. This amount will increase to $640.9 million if the underwriters exercise their option to purchase additional shares of common stock. These estimates are based on the assumed initial public offering price of $29.00 per share at the midpoint of the price range

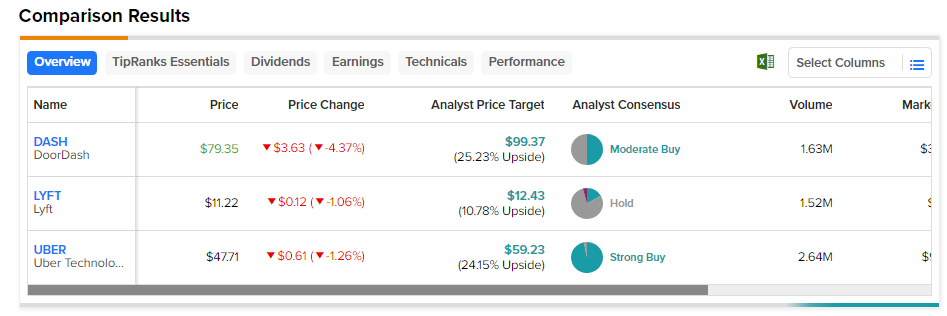

Once public, Instacart will compete with listed players in the home delivery space. These include Uber (NYSE:UBER), Lyft (NASDAQ:LYFT), and DoorDash (NYSE:DASH). Here is a look at how these listed players are faring currently with the help of the TipRanks Stock Comparison tool.