Spain-based electric utility company Iberdrola (ES:IBE)(IBDRY) plans to reduce its stake in its U.S. renewable businesses, Bloomberg reported. The report highlighted that Iberdrola is looking for a financial partner for its projects in the U.S. The move is part of the company’s 2023-2025 strategic plan, which includes reducing capital costs.

The company is focusing its efforts on building more electricity grids. Moreover, it plans to invest selectively in renewables.

Iberdrola, through its subsidiary, Avangrid (NYSE:AGR), operates offshore wind projects in the U.S. It’s worth highlighting that persistently high inflation, increasing interest rates, and supply chain constraints have raised concerns over the viability of offshore wind projects in the U.S.

Though the company passes through the incremental commodity costs to its customers, the near-term headwinds could pressure earnings. Avangrid’s management expects Q4 earnings to decline year-over-year. Given the short-term headwinds, analysts’ consensus figures call Avangrid’s stock a Moderate Sell. Furthermore, the average price target of $42.60 is roughly in line with its closing price on January 23.

While analysts are cautious about Avangrid, let’s check what analysts recommend for Iberdrola.

Is Iberdrola Stock a Buy or Hold?

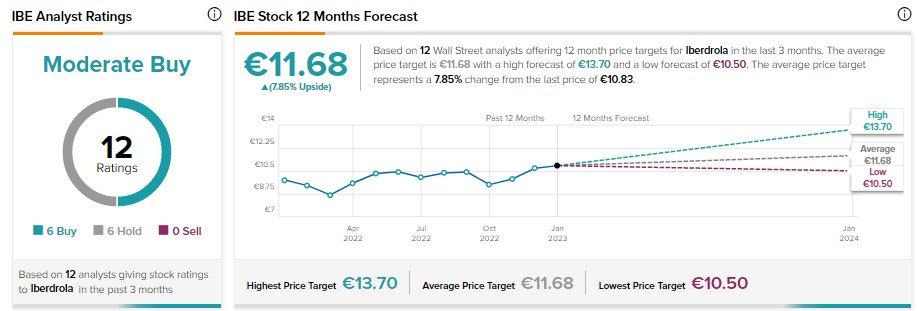

Iberdrola stock has six Buy and six Hold recommendations, translating into a Moderate Buy consensus rating. Further, analysts’ average price target of €11.68 implies 7.85% upside potential.

Join our Webinar to learn how TipRanks promotes Wall Street transparency