Today’s news proved exciting for Upstart Holdings (NASDAQ:UPST) investors, as shares shot up over 20% at one point in Tuesday afternoon’s trading. The biggest reason traces back to a report from BTIG that said Upstart was likely to do a lot better than some were expecting. With Upstart about to post its second-quarter earnings report next week, we’ll find out just how good things got.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Currently, the average analyst estimate for Upstart is $135 million even. That’s a pretty solid figure as it stands, especially since Upstart Holdings specializes in lending tools for banks driven by artificial intelligence. But BTIG—via analyst Lance Jessurun—looks for Upstart to do even better. Jessurun looks for improvements in web traffic volume as well as a conversion rate that’s slightly higher than the one previously seen but still below the levels normally seen.

Jessurun also notes that Upstart shares have been on the rise for some time, adding 73% from June 13 to today. That’s a big run and a run that suggests short sellers might be moving to cover potential losses against a whole slew of positive data. It’s a pronounced turnaround, Jessurun noted, as Upstart saw massive losses back in 2022. Yet, there were signs that investors had some fondness for Upstart stock, and a turnaround followed not too long after.

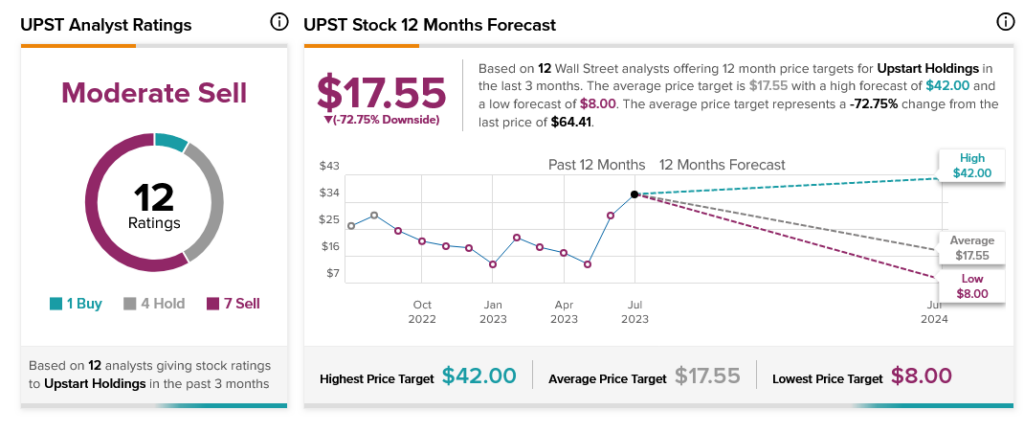

Indeed, analysts aren’t looking too favorably on Upstart’s long-term outcome. Currently, analyst consensus calls Upstart Holdings stock a Moderate Sell, supported by one Buy rating, four Holds, and seven Sells. Worse, with an average price target of $17.55, Upstart Holdings stock also comes with 72.75% downside risk.