Shares of the financial technology company Upstart (NASDAQ:UPST) are up about 220% so far this year (see the graph below). The long-term funding arrangement announced during the Q1 earnings call and expectations of easing monetary policy due to the continued moderation in the inflation rate drove UPST stock higher. Despite the positive developments, Wall Street analysts are skeptical about its near-term prospects and see significant downside from current levels based on the average price target.

Factors to Impact UPST’s Performance

Investors should note that high inflation and the Fed’s tight monetary policy to tame it drove interest rates higher. Amid macro uncertainty, higher rates led to a funding constraint in the market and adversely impacted UPST’s performance.

Most of the loans originating on its platform are taken up by institutional investors via its loan funding program and investments in asset-backed securitizations. However, third-party funding dried up as the Fed’s hawkish stance and fear of recession kept lenders and capital market participants on the sidelines.

In addition, higher loan pricing adversely impacted originations and raised concerns about delinquencies.

With the easing of inflation and expectations of a slowdown in interest rate hikes, loan originations for UPST could improve. Further, the company announced that it secured multiple long-term funding agreements in Q1, which together will deliver more than $2 billion to its platform over the next 12 months.

While the new funding agreement adds resiliency and predictability to its business, the company is sharing preferential economics with these long-term funding partners, which is a concern. These preferential economics may include modest discounting and risk sharing.

Analyst’s Take

Highlighting the sharing of risk with funding partners, David Chiaverini of Wedbush reiterated a Sell recommendation on UPST stock on July 10. In an industry note, the analyst said that he expects UPST to report solid second-quarter results led by “sequential origination volume growth.” However, he added that the loss-sharing arrangement related to the long-term funding partners will “kick in 1H24, which could be a drag on economics to UPST.”

The analyst added that UPST’s most significant risk is its reliance on third-party financing, “and this risk tends to become exacerbated during recessions.”

Is Upstart a Buy, Sell, or Hold?

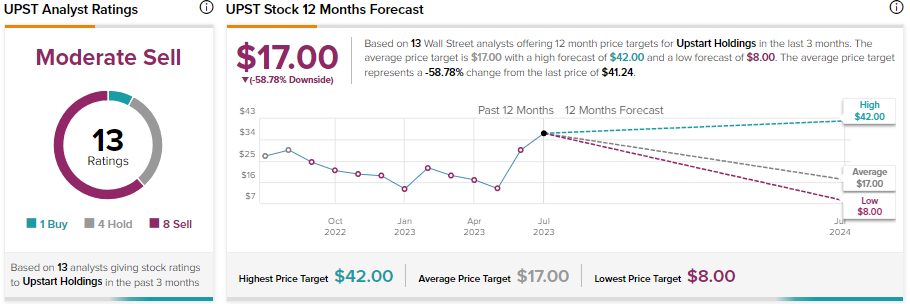

Including Chiaverini, eight analysts have rated UPST stock as a Sell. Further, it has received one Buy and four Hold recommendations. Overall, it has a Moderate Sell consensus rating on TipRanks. Analysts’ average price target of $17 implies 58.78% downside potential from current levels.