Virgin Galactic (NYSE:SPCE) released its second-quarter financial results, following which its stock is trending Lower. Shares of the space travel company were down about 5.8% in the pre-market session on Wednesday, reflecting wider losses and a revenue miss.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The commercial spaceflight and membership fees led to a significant jump in its top line, which increased to $1.87 million compared to $0.36 million in the prior-year quarter. Nevertheless, its revenues fell short of the Street’s projection of $2.52 million.

Meanwhile, Virgin Galactic reported a net loss of $134.4 million in Q2, which was greater than the net loss of $110.7 million in the prior-year period. The year-over-year increase reflects higher research and development expenses. In terms of per share, SPCE delivered a loss of $0.46 per share in Q2 compared to the analysts’ expectation of a loss of $0.51 per share. However, it was greater than the loss of $0.43 in the year-ago quarter.

Commercial Spaceflights to Drive its Revenues

Looking ahead, the company’s management expects the monthly spaceflight cadence to begin in August. It expects to launch two commercial spaceflights in Q3 and three in Q4, which will drive its revenues.

Given the flight cadence, Virgin Galactic projects approximately $1 million in revenues in the third and fourth quarters.

Against this backdrop, let’s check what Wall Street recommends for SPCE stock.

What is the Forecast for Virgin Galactic Stock?

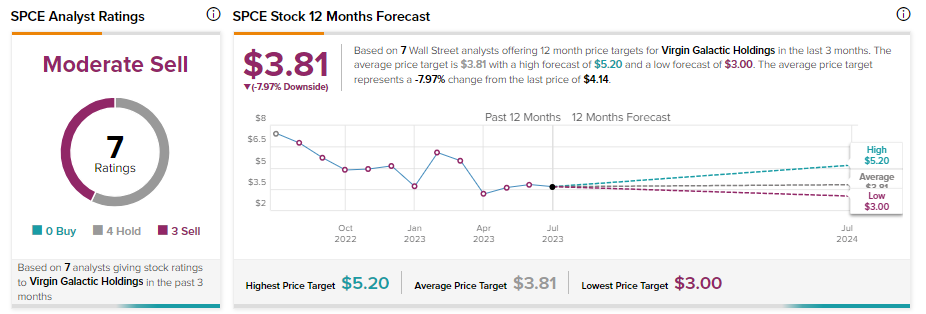

While the start of commercial spaceflights is encouraging, fear of equity dilution and continued cash burn keep analysts skeptical about its prospects. Virgin Galactic stock has received four Hold and three Sell recommendations for a Moderate Sell consensus rating.

Analysts’ average price target of $3.81 implies 7.97% downside potential from current levels.