The aerospace and space travel company Virgin Galactic (NYSE:SPCE) is scheduled to report its second-quarter financials after the market closes on Tuesday, August 1. Though the successful completion of the company’s inaugural space flight is a positive development, analysts expect SPCE’s losses to widen in Q2. Nonetheless, the company’s top line is expected to show a sharp sequential improvement.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

With this backdrop, let’s delve into Q2 expectations.

Q2 Losses to Widen for SPCE

SPCE has consistently disappointed investors on the bottom line. It has missed the Street’s forecasts in the past five consecutive quarters. (Refer to the image below.)

As for Q2, Wall Street analysts expect Virgin Galactic to report a loss of $0.51 a share, higher than the loss of $0.43 in the prior-year quarter. The higher R&D costs related to its fleet enhancement activity and the development of its future fleet will likely take a toll on its bottom line.

Though the company’s losses are expected to widen on a year-over-year basis, analysts expect its bottom line to show sequential improvement. In Q1, the company reported a loss of $0.57 a share, which missed the consensus estimate of a loss of $0.52 a share.

Besides for the sequential improvement in its bottom line, analysts expect significant quarter-over-quarter growth in its top line. For Q2, Wall Street expects Virgin Galactic to deliver revenues of $2.52 million, much higher than the sales of $392,000 in Q1. Moreover, it is considerably higher than the revenues of $357,000 reported in the prior-year quarter. The notable change in sales reflects benefits from future astronaut membership and event fees.

What is the Price Target for SPCE?

With an average price target of $3.81, SPCE stock offers a downside potential of 10.98% from current levels. Further, Wall Street analysts maintain a bearish outlook on the stock ahead of Q2 earnings due to the higher losses and continued cash burn.

It has received four Hold and three Sell recommendations for a Moderate Sell consensus rating.

Options Activity Highlights 12.21% Earnings-Related Move

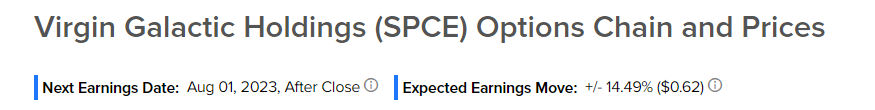

While analysts are skeptical about SPCE stock, option traders are pricing in a 14.49% move on earnings, which is greater than the previous quarter’s earnings-related move of 1.96% and the average -2.58% move in the last eight quarters.

Learn more about TipRanks’ option tool here.