Virgin Galactic’s (NYSE:SPCE) first commercial spaceflight, Galactic 01, is planned to fly between June 27 and June 30. Ahead of the start of commercial operations, shares of this space travel company fell over 18% on Friday, June 23. Nonetheless, SPCE stock is up over 3% in today’s pre-market session.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Recently, the company announced that it would raise about $400 million through the sale of common stock. The potential dilution from the issuance and sale of stock irked investors.

SPCE intends to use the cash proceeds from the stock sales to develop its spaceship fleet and the infrastructure needed to strengthen its commercial operations. In addition, it plans to use the cash for general corporate purposes.

Cash Burn a Concern

While the start of commercial spaceflight’s prolonged downtime is a positive development, its widening losses are a concern. Virgin Galactic’s losses increased to $500 million in 2022 from $353 million in 2021.

Further, SPCE delivered a net loss of $159 million in the first quarter, compared to a net loss of $93 million in the year-ago quarter. Management blamed the development of the future fleet and enhancements to the current fleet for the widening of the losses.

Following the Q1 results last month, Goldman Sachs analyst Noah Poponak said that the company’s cash burn guidance for the remaining part of this year “implies free cash burn will continue at >$100mn” per quarter. Moreover, the analyst expects the cash burn to continue through 2025.

Poponak believes that the company’s offerings are “consumer discretionary purchase” and that the current weakness in the economy could pose challenges.

The analyst recommends a Hold on SPCE stock.

Is Virgin Galactic a Hold or Sell?

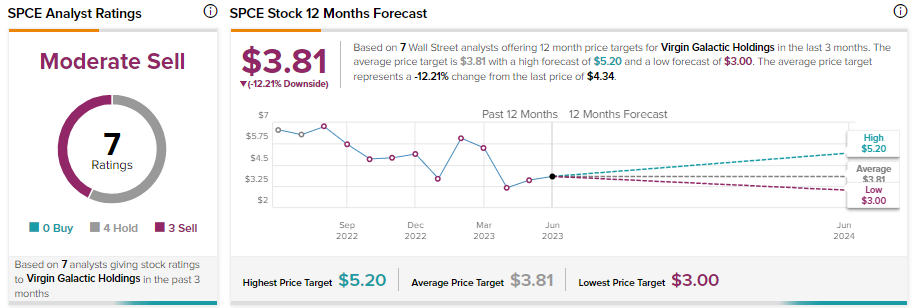

Wall Street analysts are skeptical about Virgin Galactic’s prospects. Virgin Galactic stock has received four Hold and three Sell recommendations for a Moderate Sell consensus rating. Analysts’ average price target of $3.81 implies a downside potential of 12.21% from current levels.