Tesla (NASDAQ:TSLA) continues to offer its Model 3 sedan and Model Y sport utility vehicle at a discounted price in China. The move comes as the Chinese electric vehicle (EV) market has become highly competitive; the company’s rivals, BYD Auto, XPeng (XPEV), and Nio (NIO), continue to make efforts to increase market share in China and international markets.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The discount offerings might also be seen as an effort to boost vehicle sales in order to help Tesla meet its goal of increasing deliveries by 50% annually.

Special incentives on both EVs, amounting up to $1,450, will be available to buyers, if they accept delivery of the vehicle by February 28. Also, Tesla will continue to offer a ¥6,000 ($870) discount on shipping costs and an insurance subsidy of ¥4,000 ($580).

It is worth mentioning that Tesla is expected to release its Q422 delivery numbers this week.

Is TSLA a Good Buy?

Tesla stock has tanked by about 69% over the past year. The company faced several headwinds, including supply shortages and lower demand for vehicles amid rising COVID-19 cases in China. Nevertheless, falling lithium prices and efforts to woo customers with discounts might support performance in the near term.

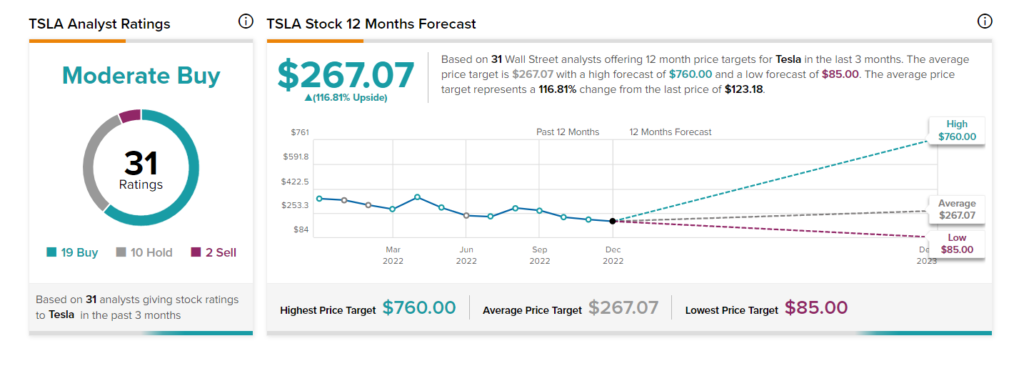

Currently, analysts are cautiously optimistic about Tesla stock. This is based on 19 Buy, 10 Hold, and two Sell recommendations on the stock. The average TSLA price target of $267.07 implies 116.8% upside potential from the current level.