Judging by the last few weeks of trading for electric car maker Tesla (NASDAQ:TSLA), the idea that things could look good in 2023 seems like a near-impossibility. However, new reports from a major analyst gave Tesla a fairly hefty boost in Thursday’s trading. Goldman Sachs (NYSE:GS), via analyst Adam Jonas, noted that Tesla is poised to accomplish two big things in 2023.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

One, it’s likely going to remain top of the heap as far as electric vehicles go. Two, it’s also likely to expand its previous lead and get farther ahead of the rest of its competitors. That’s a big step, but Jonas has some support. Tesla’s current valuation—which has been pummeled over these last several weeks—as well as its level of innovation and cost controls, add up to a solid value for investors.

Jonas also suggested that the big reason for the Tesla sell-off seen has little to do with the Twitter kerfuffle. Rather, due to an inversion in supply and demand. That all but necessitates lower prices as demand falls and supply starts to recover. Further, that, in turn, suggests that the discounts and rebates seen are just a reaction to that demand curve inversion. Jonas looks for 2023 to be a “reset” year.

In such a year, supply finally outpaces demand and gives Tesla the opportunity to win on its strengths. Indeed, Musk himself offered support for such an angle. He released a memo that thanked employees for their work in the fourth quarter. Further, he advised them not to be too concerned about the volatile stock price.

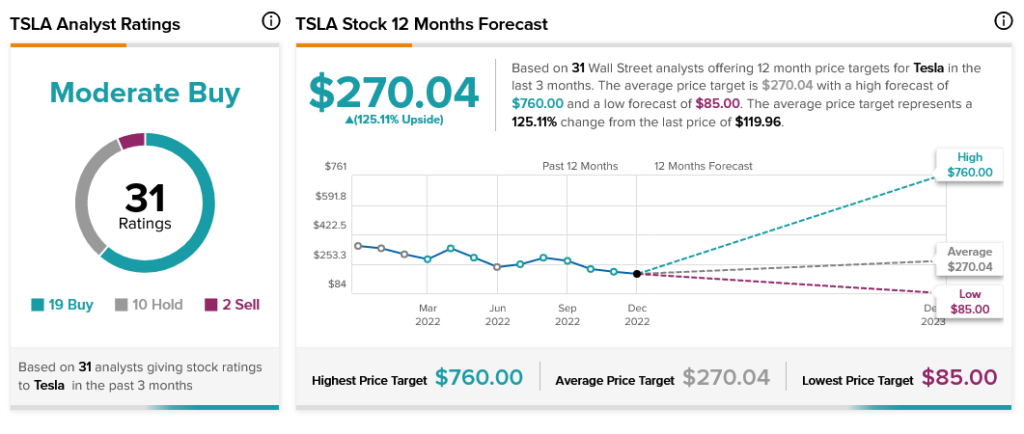

Jonas’ position is hardly unique, as analyst consensus calls Tesla a Moderate Buy. The stock’s average price target of $270.04 per share leaves it with 125.11% upside potential.

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more.