Shares of Bath & Body Works Inc. (NYSE:BBWI) shot up more than 22% in yesterday’s extended trading hours, thanks to its better-than-expected Q3 results and strong forward guidance. The company is upbeat about its cost-saving measures and the “robust gifting assortment” it has in store for the upcoming holiday season.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The personal care and home fragrance retailer reported adjusted earnings of $0.40 per share, which beat analysts’ estimates of $0.20 per share but declined 56.5% year-over-year. Meanwhile, net sales decreased 5% from the prior-year quarter to $1.60 billion. Nevertheless, it surpassed the Street’s expectations of $1.56 billion.

Bath & Body Works’ Executive Chair and Interim CEO Sarah Nash, said, “We are pleased to have delivered better-than-anticipated bottom-line performance as the team remained focused on innovation and newness, continued to leverage our vertically integrated supply chain to chase into key winners, and took aggressive action to control costs and improve overall efficiencies.”

After beating its Q3 estimates, the company has raised its guidance for full-year earnings to $3.00-$3.20 per share from the prior guidance range of $2.70 to $3.00. Further, for the fourth quarter, Bath & Body Works expects to report earnings in the range of $1.45 to $1.65.

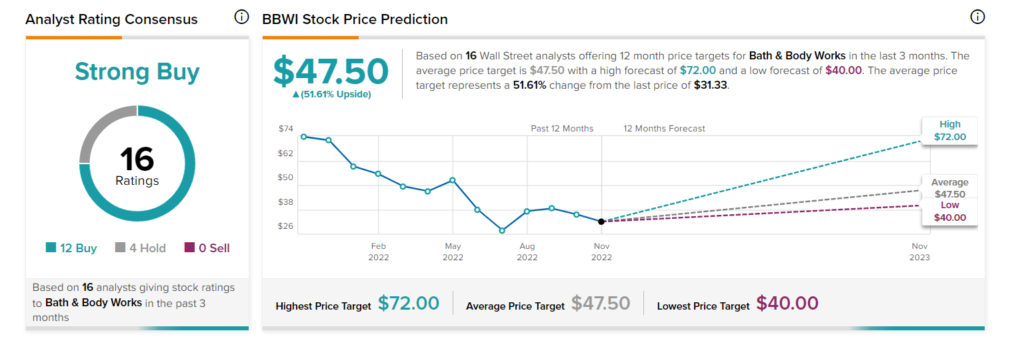

What is BBWI’s Stock Price Prediction?

On TipRanks, BBWI stock has a Strong Buy consensus rating based on 12 Buys and four Holds recommendations. Bath & Body Work’s stock average price target of $47.50 implies 51.61% upside potential.