Bank of America Corporation (NYSE: BAC) has impressed investors with better-than-expected results for the first quarter of 2022. Earnings in the quarter surpassed the consensus estimate by 8.1%, and sales exceeded analysts’ expectations by 0.4%.

Shares of this $335.2-billion bank gained 3.4% to close at $38.85 on Monday. An additional 0.5% increase was recorded in the extended trading session.

Financial Highlights

In the quarter, Bank of America’s earnings stood at $0.80 per share and surpassed the consensus estimate of $0.74 per share. On a year-over-year basis, the quarterly earnings witnessed a decline of 7%.

Revenues, net of interest expenses, surpassed the consensus estimate of $23.1 billion. Also, the top line increased 1.8% year-over-year driven by a 13.5% rise in net interest income. However, a 7.7% decline in noninterest income impacted the top-line momentum.

Total revenues (net of interest expense) increased 9.2% year-over-year to $8.8 billion for the Consumer Banking segment and rose 10.2% to $5.5 billion for the Global Wealth and Investment Management segment. The Global Banking segment’s revenues were $5.2 billion, up 12.1% year-over-year. However, revenues for the Global Markets segment declined 14.6% year-over-year to $5.3 billion.

Noninterest expense in the quarter increased 4% year-over-year to $15.3 billion.

Exiting the quarter, Bank of America’s total loans and leases were $993.1 billion, up 10% year-over-year, and total deposits were $2,072.4 billion, reflecting an increase of 9.9% from the year-ago quarter. Total nonperforming loans, leases, and foreclosed properties decreased 9.8% year-over-year to $4.8 billion.

Other Metrics

At the end of the quarter, Bank of America operated 4,056 financial centers and 15,959 branded ATMs in the United States.

Tier 1 leverage ratio in the quarter was 6.3, down from 7.2 in the year-ago quarter. Also, the tangible equity ratio at 6.2 was below the year-ago tally of 7.

Return on average assets was 0.89% in the quarter, down from 1.13% a year ago, and return on average common shareholders was 11.02, down from the year-ago figure of 12.28.

Official Comment

The CFO of Bank of America, Alastair Borthwick, said, “Going forward, and with the forward curve expectation of rising interest rates, we anticipate realizing more of the benefit of our deposit franchise.”

Analysts’ Take

On Monday, Citigroup analyst Keith Horowitz reiterated a Buy rating on Bank of America with a price target of $47 (20.98% upside potential).

The analyst opined that the bank’s earnings were better-than-expected “due to lower credit costs/reserve release” and just 20 basis points decline in the Common Equity Tier 1 (CET 1) ratio.

Overall, the Street is cautiously optimistic about Bank of America and has a Moderate Buy consensus rating based on nine Buys and six Holds. Bank of America’s average price forecast of $49.04 suggests 26.23% upside potential from current levels.

Over the past year, shares of Bank of America have slipped 0.8%.

Investors’ Sentiment

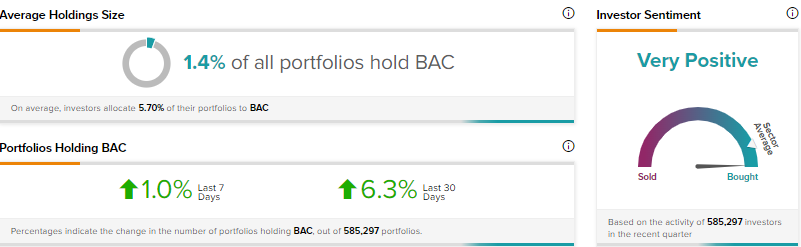

Per TipRanks’ Stock Investors tool, investors currently have a Very Positive stance on Bank of America. Further, 6.3% of portfolios tracked by TipRanks have increased their exposure to the stock over the past 30 days.

Conclusion

The Chairman and CEO of Bank of America, Brian Moynihan, said that the bank seems well-positioned to “deliver for shareholders” and keep investing in “people, businesses, and communities.”

Further, healthy growth prospects of the bank, along with effective management of the pandemic, the Ukraine-Russia war, and interest rate environment-related issues, may spike investors’ interest in this stock.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

DraftKings: Everything You Need to Know Ahead of Earnings

Volta Posts Mixed Q4 Results

How to Predict Companies’ Reports, Ahead of Earnings