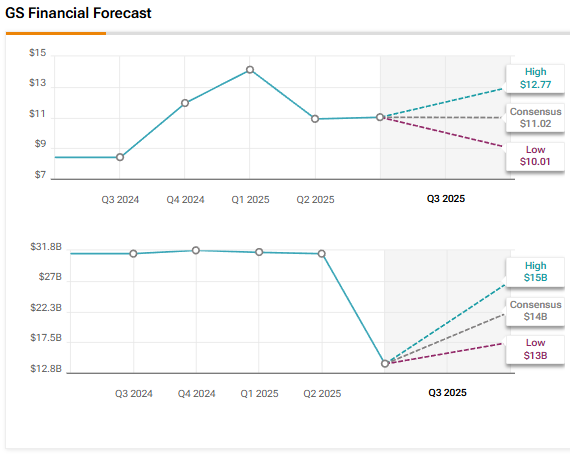

Investment bank Goldman Sachs (GS) is scheduled to announce its third-quarter results on Tuesday, October 14. Analysts expect the company to gain from continued strength in trading revenue and investment banking fees amid a rebound in dealmaking activity. GS stock has risen 33.5% year-to-date, outperforming the broader market. Wall Street expects Goldman Sachs to report earnings per share (EPS) of $11.02, reflecting a 31% year-over-year growth.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Meanwhile, revenue is estimated to grow by 11.2% to $14.1 billion. Investors will focus on management’s commentary about the state of the U.S. economy and outlook for the quarters ahead.

Analysts’ Views Ahead of Goldman Sachs’ Q3 Earnings

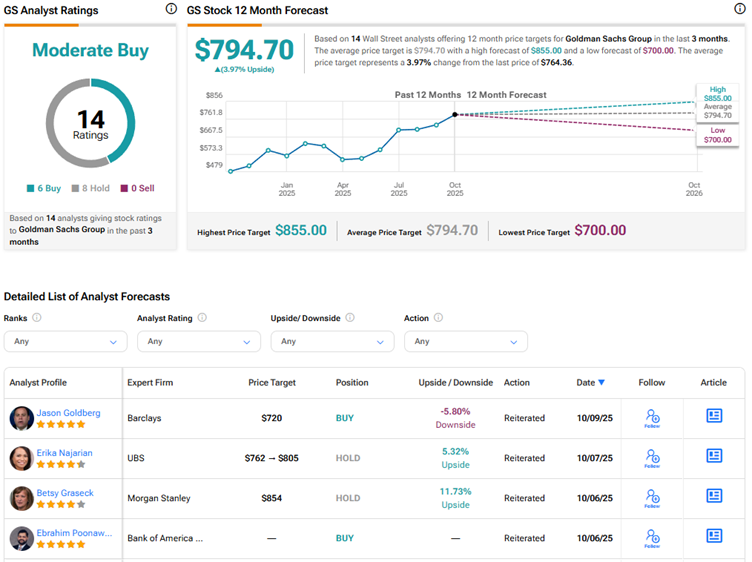

Earlier this month, BMO Capital analyst Brennan Hawken initiated coverage of Goldman Sachs stock with a Hold rating and a price target of $785. The 5-star analyst believes that Goldman Sachs has strong operating leverage and is well-positioned to benefit from the recovery in capital markets.

However, Hawken remains on the sidelines on GS stock as he believes that much of the upside potential from the investment bank’s improved returns, regulatory relief, and capital deployment seems to be already priced into the shares.

Meanwhile, Evercore analyst Glenn Schorr increased his price target for Goldman Sachs stock to $830 from $752 and reiterated a Buy rating. The top-rated analyst noted that big banks had “a stellar summer,” with stocks rallying about 20% over the season. Schorr added that he sees potential for beat-and-raise, especially for JPMorgan (JPM) and Goldman Sachs, though Citi (C) might face a downward revision due to its Banamex stake sale.

AI Analyst Is Bullish on Goldman Sachs’ Stock Ahead of Q3 Print

Interestingly, TipRanks’ AI Analyst has assigned an Outperform rating to Goldman Sachs stock with a price target of $897, indicating about 17.4% upside potential. TipRanks’ AI Analyst’s score is based on robust financial performance and bullish technical indicators. GS’ strategic growth in investment banking and asset management further supports a favorable outlook.

However, Goldman Sachs’ high leverage and cash flow challenges, along with moderate valuation metrics, slightly temper the AI Analyst’s overall score.

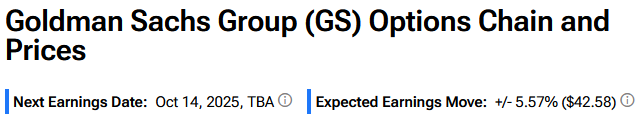

Options Traders Anticipate a Major Move on Goldman Sachs’ Q3 Earnings

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting about a 5.6% move in either direction in GS stock in reaction to Q3 2025 results.

Is GS Stock a Good Buy?

Overall, Wall Street has a Moderate Buy consensus rating on Goldman Sachs stock based on six Buys and eight Holds. The average GS stock price target of $794.70 indicates a 4% upside potential from current levels.