General Motors’ (GM) Cruise is set to leverage ride-sharing service provider Uber’s (UBER) platform to offer its robotaxis starting next year. Cruise’s Chevrolet Bolt-based autonomous vehicles (AVs) will be offered for commercial trips to customers on Uber as part of a multi-year deal. The partnership is a big step for GM’s Cruise as it tries to make a comeback after several incidents and regulatory probes, which forced it to withdraw its robotaxis from the road. GM shares rose 1.5% in extended trading yesterday on the news.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Cruise-Uber Aim to Capture Growth with Robotaxis

Uber already offers robotaxis on its platform in partnership with Alphabet’s (GOOGL) Waymo. Recently, Waymo hit a new weekly high milestone of offering over 100,000 paid trips per week. Waymo’s commercial success so far means that driverless taxis are truly viable.

Once General Motors’ Cruise hits the roads again, it will have to ensure that major crashes like the one in San Francisco do not reoccur. Last year, a pedestrian in San Francisco was struck by a car and then hit a second time by a Cruise robotaxi, which dragged the pedestrian 20 feet.

The Robotaxi Landscape

The robotaxi landscape is currently challenged with massive investments, enhanced safety standards, and strict regulatory scrutiny. Several companies are trying to get their hands on the yet nascent AV robotaxi market. Some of the notable ones include Amazon’s (AMZN) Zoox and Tesla’s (TSLA) soon-to-be-launched CyberCab.

Meanwhile, Cruise plans to launch its own driverless robotaxi service and app, irrespective of its partnership with Uber.

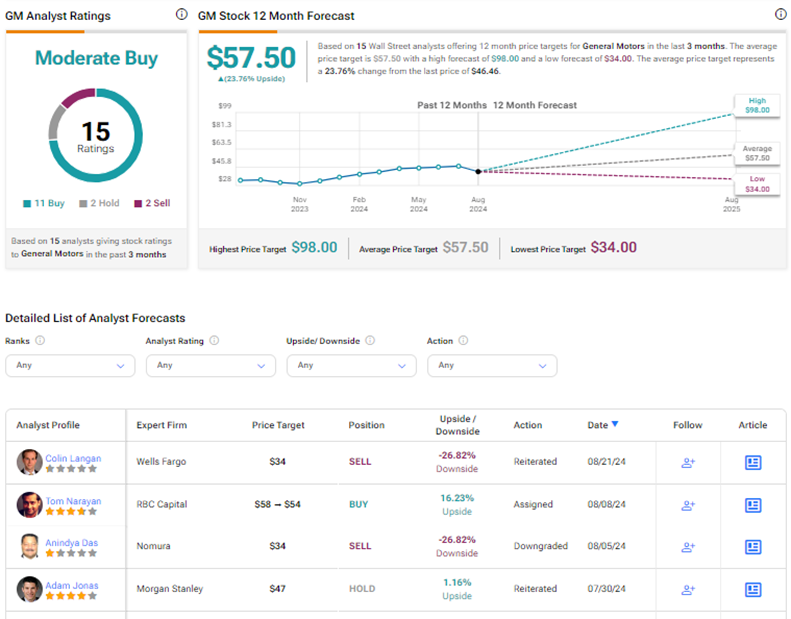

What Is the Price Target for GM?

On TipRanks, the average General Motors price target of $57.50 implies 23.8% upside potential from current levels. Shares have gained 30.1% year-to-date. GM stock has a Moderate Buy consensus rating based on 11 Buys, two Holds, and two Sell recommendations.

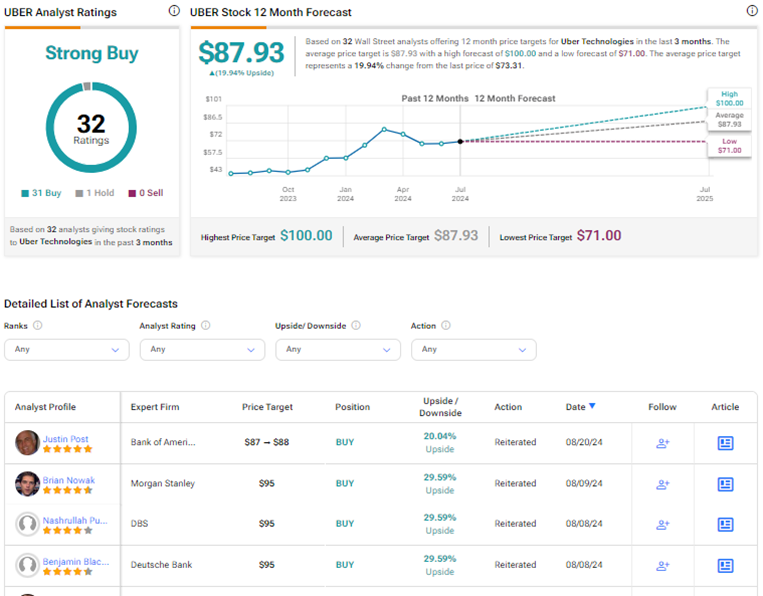

Is Uber a Buy or Sell Right Now?

UBER stock commands a Strong Buy consensus rating based on 31 Buys and one Hold rating on TipRanks. The average Uber Technologies price target of $87.93 implies 19.9% upside potential from current levels. Year-to-date, UBER shares have gained 19.1%.