General Motors (NYSE:GM) is seeking millions in back taxes and penalties from San Francisco. According to Reuters, the automaker has alleged that it was charged higher taxes than warranted by the city.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Reportedly, the company is now seeking back taxes to the tune of $108 million and $13 million in penalties and interest in a lawsuit filed in California Superior Court. GM’s self-driving unit, Cruise, has been in turmoil after safety incidents in San Francisco led to a safety investigation and the resignations of its CEO, Kyle Vogt, and Co-Founder Dan Kan. Additionally, GM slashed nearly 900 positions at Cruise. GM clocked sales of about $677,000 in San Francisco in 2022. It had a revenue target of $1 billion from Cruise by 2025.

The automaker contends that over seven years, Cruise was improperly used to calculate taxes. It emphasizes that Cruise functions independently from GM, suggesting that the company’s liabilities in San Francisco should not be based on the self-driving unit. Apart from the substantial headcount trim, Cruise has also withdrawn its vehicles from the roads.

Recently, GM temporarily halted the sales of its Chevy Blazer EVs due to software issues. Despite these challenges, investor optimism has lifted the company’s share price by 28% over the past month. Moreover, GM is aiming to invest $35 billion in electric and autonomous vehicles between 2020 and 2025.

Is GM Stock Expected to Go Up?

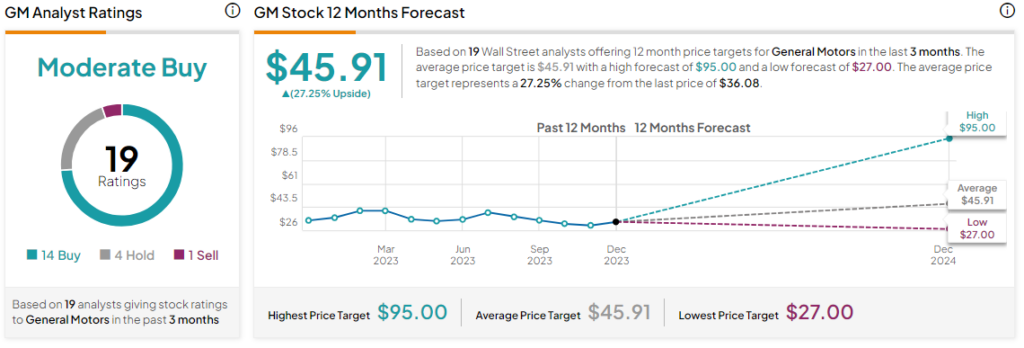

Overall, the Street has a Moderate Buy consensus rating on General Motors, and the average GM price target of $45.91 implies a substantial 27.25% potential upside in the stock.

Read full Disclosure