Automaker General Motors (NYSE:GM) has temporarily halted the sales of its recently introduced Chevy Blazer EVs (electric vehicles) due to reported software issues affecting some customers. The Blazer EV, unveiled a few weeks ago, holds a crucial position in GM’s EV lineup and is a key element of the company’s strategy to transition to an all-electric future.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

GM has clarified that the software-related quality concerns do not pose safety risks and are unrelated to the Ultium platform or Google Built-In. Despite this temporary halt, GM remains committed to its broader initiative for an all-electric future. Notably, the company plans to invest $35 billion in EV and AV (Autonomous Vehicles) product development between 2020 and 2025.

In response to a slowdown in near-term EV demand, GM is moderating the pace of its EV expansion in 2024 and 2025 to maintain strong pricing, thereby providing a cushion for its profit margins. Additionally, the company is concentrating on improving production efficiency to reduce costs and enhance profitability. With this backdrop, let’s look at the Street’s forecast for GM stock.

Is GM a Good Stock to Buy?

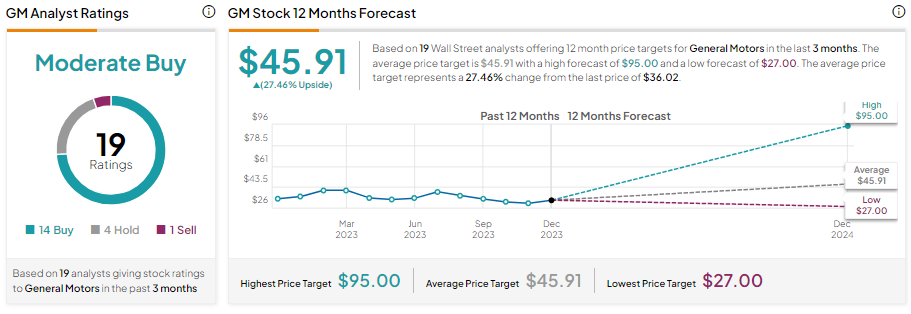

Wall Street analysts are cautiously optimistic about GM stock as higher interest rates have adversely impacted industry-wide vehicle sales. With 14 Buy, four Hold, and one Sell recommendations, GM stock has a Moderate Buy consensus rating.

GM stock is up about 8% year-to-date and underperformed in the broader markets this year as it navigated the logistics and UAW strike challenges. Meanwhile, analysts’ average price target of $45.91 implies 27.46% upside potential from current levels.