Cruise, the self-driving unit of automaker General Motors (NYSE:GM), is being probed by an auto safety regulator in the U.S., according to Reuters. The Office of Defects Investigation of the National Highway Traffic Safety Administration (NHTSA) is investigating if Cruise is taking necessary precautions with its autonomous vehicles for pedestrian safety.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The regulator has received reports of Cruise vehicles encroaching on pedestrians and incidents leading to pedestrian injury. Such incidents highlight the potential risks of the technology being tested.

The California Department of Motor Vehicles (DMV) is also probing incidents that involve Cruise’s San Francisco operations after the company’s taxi crashed with an emergency vehicle. In August, despite stiff opposition, the California Public Utilities Commission voted to allow Cruise and Alphabet’s (NASDAQ:GOOG) (NASDAQ:GOOGL) Waymo to deploy more self-driving cars in San Francisco and to begin charging for the rides.

While automakers tout the advantages of the solution, concerns over autonomous driving features continue to persist. EV pioneer Tesla (NASDAQ:TSLA) is also facing a civil lawsuit involving a fatality allegedly caused by its autopilot driver assistant.

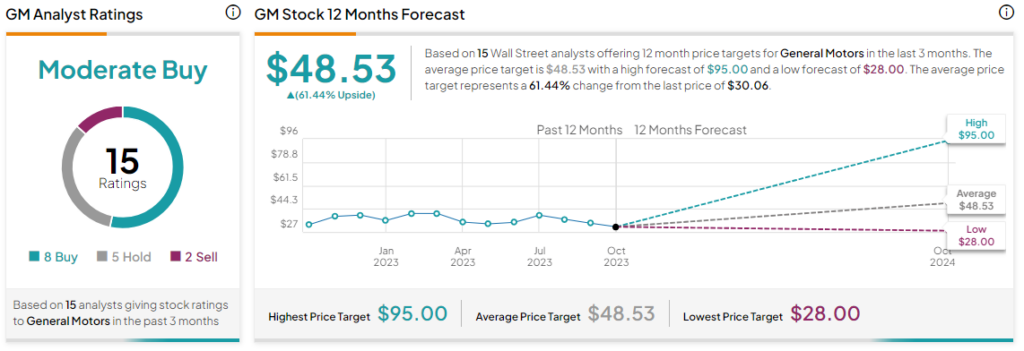

Is GM a Buy, Sell, or a Hold?

Overall, the Street has a Moderate Buy consensus rating on General Motors. The average GM price target of $48.53 implies a substantial 61.4% potential upside.

Read full Disclosure