Shares of British retailer WH Smith (GB:SMWH) fell over 2% despite the company reporting solid sales in its Travel business, which includes stores at airports, train stations, and motorway service areas. Spending on travel continues to be resilient, even as macro challenges persist. However, shares fell as investors were disappointed with the performance of the company’s High Street business, which comprises stores in U.K.’s high street locations.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

More on WH Smith’s Trading Update

In the 20-week period ending January 20, 2024, WH Smith reported an 8% rise in the overall revenue. The top line gained from a 13% rise in revenue from the company’s Travel segment, partially offset by a 4% decline in the High Street business. The like-for-like revenue growth was 5% in the reporting period.

Within its Travel segment, the U.K., North America, and the Rest of the world witnessed revenue growth of 15%, 7%, and 19%, respectively. The company recently opened its largest store for travel essentials at Birmingham airport.

As the High Street business remains challenged, the company aims to expand the presence of its Travel business, especially in North America. It plans to open more than 50 stores in North America in the current Fiscal Year, 15 in the U.K., and over 40 stores in the Rest of the World.

The company is also focused on driving efficiencies in its High Street business and is on track to generate cost savings of £10 million.

Are WH Smith Shares a Buy?

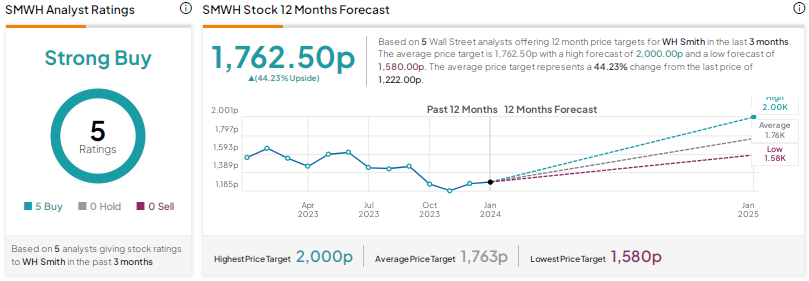

Analysts are highly optimistic about SMWH stock, with a Strong Buy consensus rating based on five unanimous Buys. The WH Smith share price target of 1,762.50p implies 44.2% upside potential. WH Smith shares have declined more than 23% in the past year.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue