In key news on UK stocks, Imperial Brands (GB:IMB) remains on track to achieve its half-year and full-year targets for FY24, as outlined in its pre-close trading update. For the first half, the company expects its operating profit to surpass that of H1 2023 on a constant currency basis. For the full year, tobacco and NGP (new generation products) net revenue is forecast to rise by low single-digits in constant currency. Also, the group’s adjusted operating profit is expected to grow towards the middle of the mid-single-digit range.

Following the update, IMB shares opened higher during early trading hours but have since declined by 0.34% as of writing.

Imperial Brands is a leading tobacco manufacturing company, with well-known brands like West, Davidoff, and Gauloises.

Tobacco Pricing and NGP Bolsters IB’s Performance

Imperial Brands’ financial performance was fuelled by robust pricing for combustibles and the expansion of NGP. The net revenue from NGP grew by 26% in 2023 and is expected to increase by mid- to high-teens at constant currency in H124. This reflects the company’s efforts to expand its presence in over 20 European markets and the U.S., along with new products.

With its pricing policies, the company also effectively offset the lower volumes in specific markets. Moreover, Imperial Brands has managed to sustain its growth despite the increasing regulatory pressures on the tobacco and vaping sectors.

The company will announce its interim results for the six months ending March 31, 2024, on May 15.

Is Imperial Brands a Good Buy?

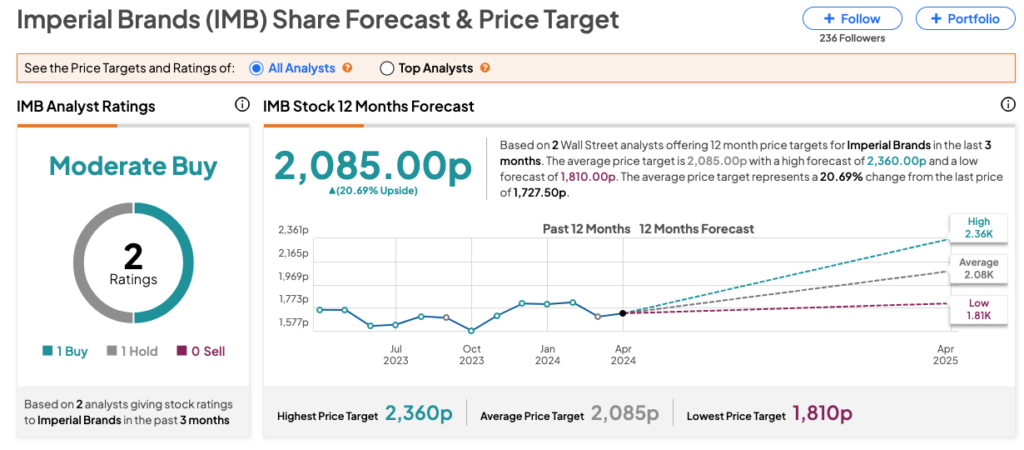

Post-update, analyst Simon Hales from Citi reduced his price target from 2,050p to 2,010p while maintaining his Buy rating on IMB stock. Overall, Hales keeps a positive outlook on the company’s performance. The reduced price target reflects recent adjustments in volume expectations for the company, primarily due to disruptions in the AAACE (Africa, Asia, Australasia, Central & Eastern Europe) region.

According to TipRanks consensus, IMB stock has received a Moderate Buy rating based on one Buy and one Hold recommendation. The Imperial Brands share price target is 2,085p, reflecting a 21% increase from the current trading level.