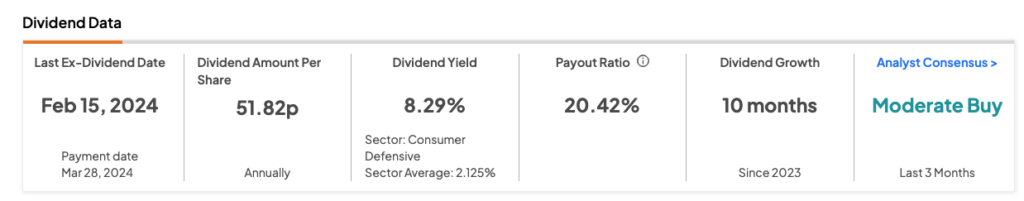

Among the famous UK stocks, Imperial Brands (GB:IMB) boasts a high dividend yield of 8.29%, significantly surpassing its sector average of 2.12%. The company adopts a progressive dividend growth policy and is committed to increasing its dividends every year. Imperial Brands is a leading tobacco manufacturing company with well-known brands like West, Davidoff, Gauloises, and more.

TipRanks provides a range of tools to assist users in identifying dividend stocks that align with their preferences. In this case, we utilized the TipRanks Top Dividend Shares for the UK market. This tool compiles a detailed list of high-dividend-paying companies, along with several other criteria for users to evaluate.

Let’s take a look at the details.

Imperial Brands’ Dividends in 2023

In 2023, the company paid a total dividend of 146.82p per share, up from 141.17p paid in 2022. This included a final dividend of 51.82p per share paid on March 28, 2024, which marked an increase of 4% compared to the previous year.

The company returned £2.3 billion to shareholders through dividends and share buybacks in 2023. It has further committed to a £1.1 billion share buyback program to be finalized in FY24, marking a 10% increase from FY23. Throughout FY23 and FY24, the company aims to achieve cumulative capital returns of £4.7 billion through a blend of dividends and a share buyback program.

Dividends Backed by Profit Growth

The growth in dividend payments was driven by higher profits despite a fall in revenues. Ppre-tax profits increased by 22% to £3.11 billion in 2023 compared to the previous year. Additionally, the company reported revenue of £32.48 billion, a slight decrease of 0.2% from £32.55 billion in the prior year. The net revenue from next-generation products grew by 26%.

The company remains confident that it is well-placed to maintain its commitment to enhancing returns to investors, with plans to increase its dividend payout and buyback program.

Is Imperial Brands a Good Buy?

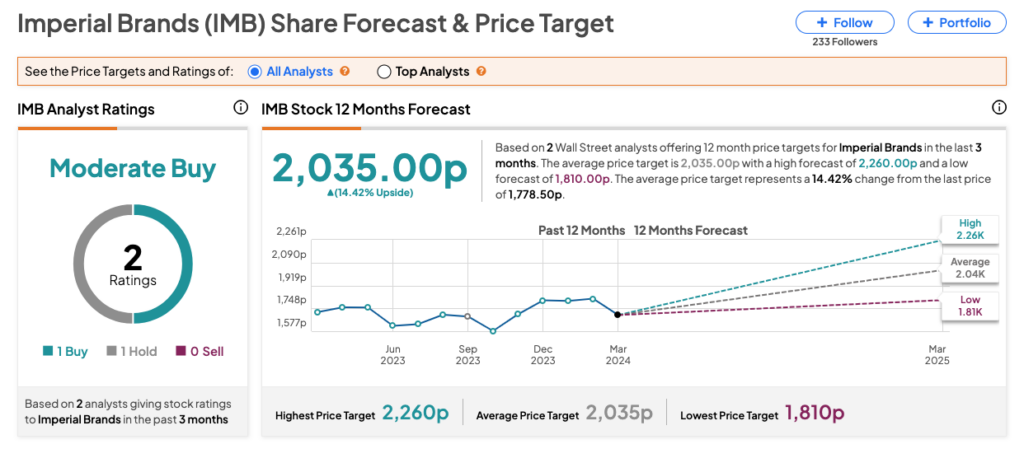

According to TipRanks consensus, IMB stock has received a Moderate Buy rating based on one Buy and one Hold recommendation. The Imperial Brands share price target is 2,035p, reflecting a 14.42% increase from the current trading level.