In key news for UK stocks, Halfords Group PLC (GB:HFD) shares are crashing today after the retailer slashed the profit outlook for the ongoing Fiscal year. Halfords operates a retail chain of motoring and cycling products and services across the UK. Citing “further material weakening” of its Cycling, Retail Motoring, and Consumer Tyres markets, the company cut down its guidance. HFD shares were down 30.7% as of writing, hitting a new 52-week low of 136.04p.

For the 52 weeks ending March 29, 2024, Halfords now projects underlying profit before tax to be between £35 to £40 million, down from the prior guide of £48 to £53 million. This is the second time that Halfords is cutting its profit outlook for Fiscal 2024. In November 2023, Halfords revised the upper end of its profit guidance to £53 million from £58 million due to weaker demand momentum.

Further Details of Halfords’ Profit Forecast

Halfords pointed out two key reasons for the weakening conditions. First, a continued deceleration in consumer sentiment and unexpectedly mild and very wet weather that have impacted the footfall in the Cycling and Retail Motoring stores. This has also affected the sales of winter and car cleaning products.

As a result, volume in the three markets, namely Cycling, Retail Motoring, and Consumer Tyres, fell by 8%, 5.1%, and 4.3%, respectively, in January as compared to the prior-year period.

Secondly, the Cycling market has become more challenging due to intense competition, consolidation, higher promotional expenses, and increased credit purchases, resulting in weaker gross margins. Meanwhile, the conditions in the Service, Maintenance and Repair (“SMR”) market remained stable and the company saw good momentum.

For Fiscal 2025, Halfords does not foresee an immediate market recovery in the near term. This uncertainty, coupled with macro challenges, makes forecasting challenging. Having said that, Halfords is confident that it is well-positioned to benefit from a recovery in the market and gain its competitive position.

Are Halfords Shares a Good Buy?

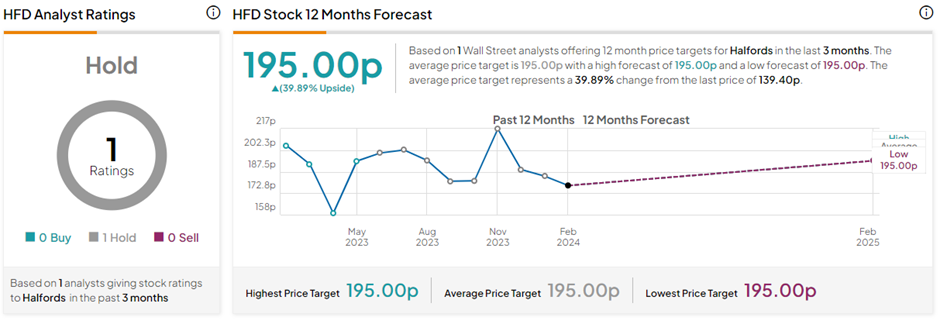

With only one Hold rating received during the past three months, HFD stock has a Hold consensus rating on TipRanks. The Halfords Group PLC share price forecast of 195p implies 39.9% upside potential from current levels.