Halfords Group PLC (GB:HFD) witnessed a sharp decline in its share price yesterday after the company reduced its annual profit forecast range. During its half-year results for FY24, the company revised its outlook for fiscal year 2024, citing reduced demand for its products. It now anticipates an underlying pre-tax profit ranging from £48 million to £53 million, down from the earlier guidance of £48 million to £58 million. The revision is attributed to customers cutting back on discretionary spending, reflecting broader economic trends impacting consumer behavior.

The stock ended the day with a decline of around 18% on Tuesday. The stock also experienced a drop to its lowest level in seven months during early trading hours yesterday.

Halfords holds the position of a leading retailer in the UK for motoring, cycling, and leisure products, along with a range of associated services.

Let’s take a look at some of the numbers.

Half-Year Results Snapshot

In the first half of FY24, the company reported a 3.3% increase in pre-tax profit, reaching £19.3 million. The underlying pre-tax profit saw a more substantial rise, surging by 15.8% to £21.3 million. Furthermore, revenue climbed by 13.9%, reaching £873.5 million, accompanied by a robust like-for-like sales growth of 8.3%.

Halfords noted that trading patterns have been unpredictable in the first half of the year. It has noted a slowdown in the market demand for discretionary big-ticket categories, leading to lower like-for-like sales growth.

Nonetheless, the company maintains its expectation that profit delivery for the fiscal year 2024 will be weighted towards the second half. This anticipation is based on the fact that the effects of inflation will be spread across the full year. Moreover, the company will achieve its remaining cost savings of £30 million in the second half.

Is Halfords a Good Buy?

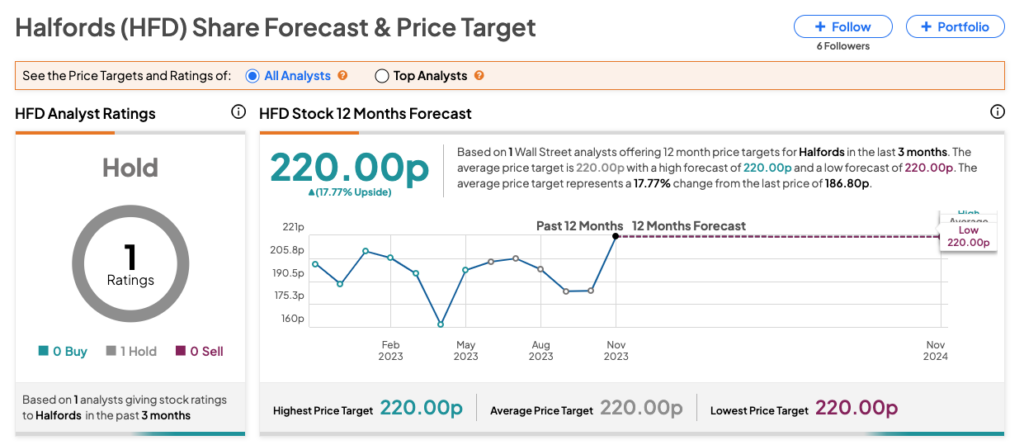

On TipRanks, HFD stock has a Hold rating based on one Hold recommendation from RBC Capital analyst Manjari Dhar. The Halfords share price target is 220p, which is 18% higher than the current trading levels.