British car manufacturer Aston Martin Global Holdings PLC (GB:AML) published its second-quarter earnings with better revenue growth, driven by demand for its limited edition models and higher prices. The company’s shares also drove higher and gained almost 7% at the time of writing. So far this year, the stock has demonstrated remarkable growth, surging by 137%.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Strong Numbers and an Even Stronger Outlook

The company posted a 25% growth in its revenues to £677 million, driven by its DBX and V12 Vantage sales volumes. The company’s average selling price also grew by 14% to £212,000. In the first half, the gross profit rose by 26% to £236 million, maintaining a gross margin of 35%. The upswing in gross profit was primarily attributed to pricing dynamics and increased volumes, which neutralized the higher manufacturing, logistics, and other costs.

The company witnessed high demand for its retail portfolio with a solid order book for DBX models. Moreover, the newly launched DB12 Coupe has already sold out for the entire year of 2023, shortly after its release at the end of May.

Well-supported by such positive numbers, the company’s adjusted earnings grew by 38% to £81 million.

For 2023, Aston Martin maintained its forecast, expecting volumes of approximately 7,000 vehicles and an adjusted core profit margin of around 20%. In the medium term, the company is confident it will achieve its targets of £2 billion in revenue and around £500 million in adjusted EBITDA by 2024/25.

What is the Future Price of Aston Martin Stock?

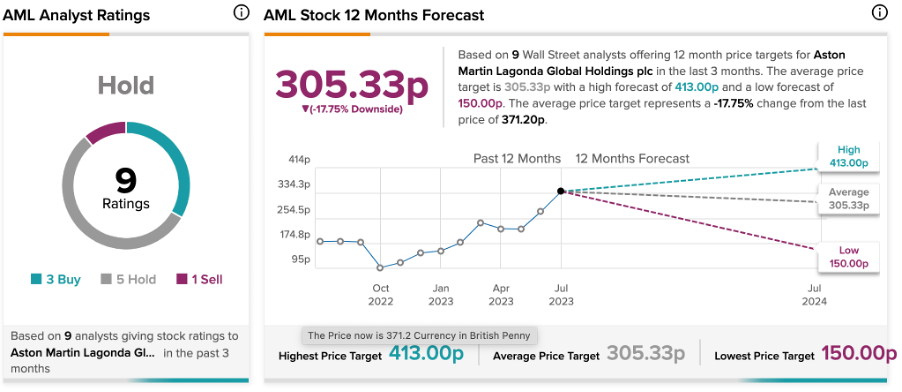

On TipRanks, AML stock has a Hold rating based on three Buy, five Hold, and one Sell recommendations.

At an average target price of 305.3p, analysts are predicting a downside of 17.7% in the share price, as it is already trading at higher levels.