Uber Technologies, Inc. (NYSE:UBER) (GB:0A1U) has encountered a setback in its ambitious endeavor to shift its fleet from gasoline-powered to all-electric vehicles. In May, the company announced its plan to have all of its London cab drivers switch to electric cars by the end of 2025, making it the company’s first all-electric location.

As part of this plan, the company installed four EV chargers, which indicates a slow start considering the target to install hundreds by this time. Moreover, the number of Uber drivers using EVs in the city has increased at a slower rate than anticipated by the company.

Cracking the Challenging EV Market

For a considerable time, Uber has been promoting London as the prime example of its green initiatives. The company wants to lead the EV transition race in London, which makes sense with new, stricter emissions regulations in the city. However, it has encountered unexpected hurdles and is falling behind its projected timeline. The cost of charging EVs has risen in numerous regions globally, and insufficient infrastructure leads to time-consuming and stressful experiences. This serves as a cautionary tale for companies like Uber with high sustainability objectives.

Uber is allocating $800 million globally to facilitate the transition to electric vehicles (EVs). The company aims to achieve full electrification in U.S. and Canadian cities by 2030. It intends to have half of its total miles driven across seven major European cities accomplished through EVs by 2025. Moreover, Uber’s plan involves becoming all-electric in all other cities worldwide by 2040.

Uber Stock Prediction

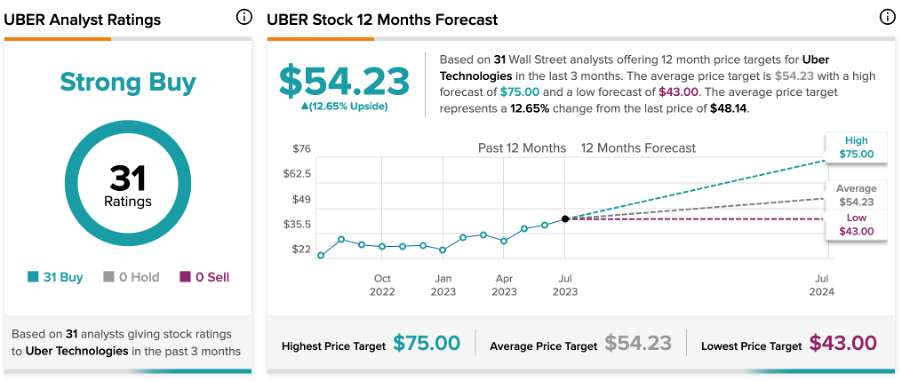

According to TipRanks consensus forecast, UBER stock has a Strong Buy rating backed by a total of 31 recommendations. This includes all 31 Buy ratings from analysts. This demonstrates the growing assurance and backing from experts in the investment community.

In 2023, the company’s stock experienced an impressive rally, boasting a YTD gain of nearly 90%. Overall, the stock has an average price forecast of $54.23, which implies an upside potential of 12.6%.

Recently, three days ago, Jason Helfstein from Oppenheimer reiterated his Buy rating on the stock, suggesting a growth rate of 35% in the share price.