Investment bank Jefferies downgraded the rating for the UK-based packaging company Mondi PLC (GB:MNDI) from Buy to Hold, citing limited upside in the near term. However, analyst Cole Hathorn from Jefferies still believes in the stock’s long-term potential, considering the company’s solid fundamentals. Hathorn’s price target of 1,650p reflects an upside of about 10% in the stock.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The share price traded down by 2.28% on Friday.

Mondi PLC is a leading manufacturing company specializing in the production and distribution of pulp, paper, and flexible plastic packaging products.

Reasons for Rating Downgrade

Hathorn downgraded Mondi stock despite describing the company as a “structurally well-placed, low-cost paper and packaging producer,” as he believes there is no immediate catalyst for the company that can push the share price higher.

He added that if investors keep patience and hold on to the stock for the long term, they could benefit from the company’s wise decisions, financial flexibility, and potential mergers and acquisitions after 2025.

Before this, UBS analyst Andrew Jones also downgraded his rating on Mondi stock from Buy to Hold in December.

Earnings Snapshot

In October 2023, Mondi PLC reported an EBITDA of £261 million in the third quarter, compared to £450 million in the prior-year’s comparable quarter. The company attributed the decline to reduced market demand and lower average selling prices.

Interestingly, Hathorn expects the company’s earnings to gain from its capital allocation strategy. The company will publish its Q4 and full-year results for 2023 on February 22, 2024.

Looking ahead, Mondi expects the lower demand trend to continue in Q4, along with stable input costs and an impact from maintenance and project-related shutdowns. Despite these challenges, the company expresses confidence in its low-cost asset base and diverse product range, which are expected to provide resilience in this economic environment.

Is Mondi a Good Stock to Buy?

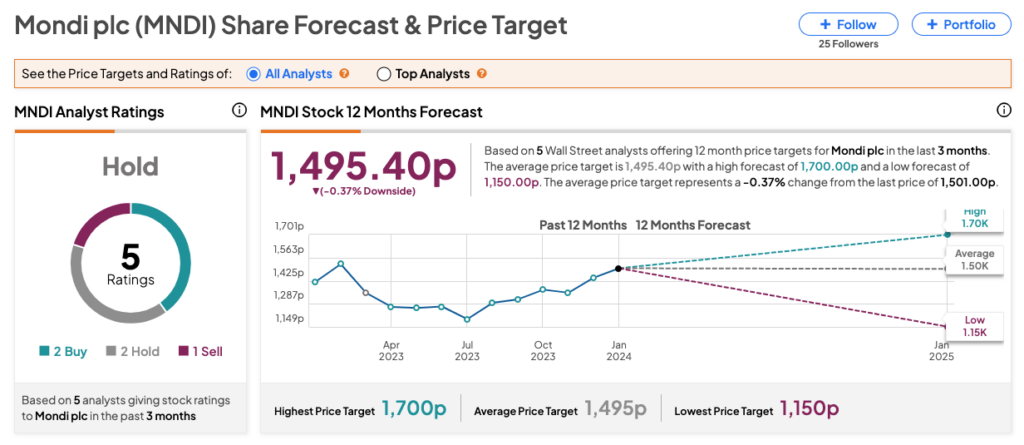

According to TipRanks consensus, MNDI stock has received a Hold rating based on two Buys, two Holds, and one Sell recommendation. The Mondi share price target is 1,495.40p, which indicates that the stock is fully valued at current levels.