UK-based Mondi PLC (GB:MNDI) yesterday reported lower earnings in its Q3 trading update for 2023, sending shares down by around 7%. The company posted EBITDA of £261 million in the third quarter, down from the £450 million reported in the same quarter last year. The company stated that the decline in earnings was attributed to lower market demand along with lower average selling prices and a “much-reduced forestry gain.”

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Earlier this month, the company’s shares were in the news after it completed its exit from Russia by divesting its largest facility, Mondi Syktyvkar, for $826 million. This time, the company successfully obtained the necessary regulatory approvals in Russia for the deal after withdrawing from the agreement in June 2023.

Mondi PLC is a prominent manufacturing company focused on producing and distributing pulp, paper, and flexible plastic packaging products. With a global presence, the company serves a broad customer base in approximately 30 countries.

Q3 2023 Trading Update

In its Corrugated Packaging segment, containerboard prices remained steady, and its order books showed signs of improvement. In Flexible Packaging, there were continued decreases in both price and volume, particularly in kraft paper, which typically experiences later-cycle trends. Pricing for Uncoated Fine Paper continued to decrease in Europe due to weak demand. The forestry fair value gain, which is included in the Uncoated Fine Paper segment, amounted to €14 million in Q3 2023. This marked a huge decrease from the €72 million reported in Q2 2023.

Moving forward, the company anticipates that this demand pattern will persist in Q4, coupled with steady input costs and an increased impact from maintenance and project-related shutdowns. Nevertheless, the company is confident in its low-cost asset base and diverse product range to offer resilience in this climate.

Are Mondi Shares a Good Buy?

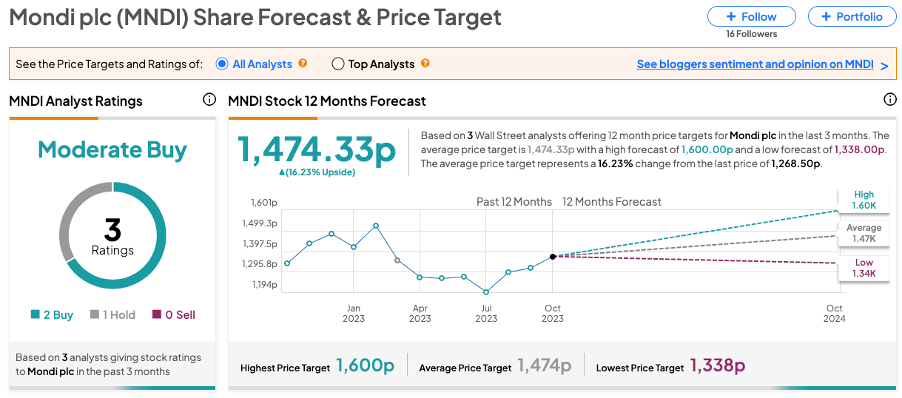

Analysts remain bullish on the long-term prospects of the company and believe it is well-placed to recover when market conditions improve. Post-Q3 update, analyst Detlef Winckelmann from J.P. Morgan reiterated his Buy on the stock, expressing his bullish stance on the numbers. His price target of 1,507p implies an upside potential of 18.6%.

Morgan Stanley analyst Brian Morgan maintained his Hold rating on the stock, forecasting a growth rate of 33.8%.

According to TipRanks consensus, MNDI stock has received a Moderate Buy rating based on two Buy and one Hold recommendations. The Mondi share price target is 1,474.33p, which is 16.13% above the current trading level.