In major news on UK stocks, shares of DS Smith PLC (GB:SMDS) surged after its packaging competitor Mondi PLC (GB:MNDI) made a £5.14 billion (or $6.5 billion) bid to acquire the company. SMDS stock has been on an upward journey following the revelation of Mondi’s interest last month. After today’s announcement, SMDS stock soared to a new one-year high and gained over 6%. On the other hand, Mondi’s shares were trading down by 2% at the time of writing.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Mondi is a multinational company specializing in paper, plastic, and flexible packaging, with operations spanning Europe, North America, and South Africa. DS Smith is a relatively smaller player in the same industry.

Details About the Offer

The deal values DS Smith at 373p per share, which is 33% above its stock’s closing price before Mondi publicly expressed interest last month.

According to the joint statement issued by the companies, the combined group has an exciting opportunity to establish itself as a pan-European industry leader. Moreover, both companies complement each other geographically and also in terms of customers.

Overall, the companies in the packaging sector have experienced challenges due to lower volumes and prices, as customers reduced their inventory levels due to difficult market conditions. With this deal, the two companies are confident about generating synergies, benefitting shareholders on both sides.

What is the Stock Price Forecast for DS Smith?

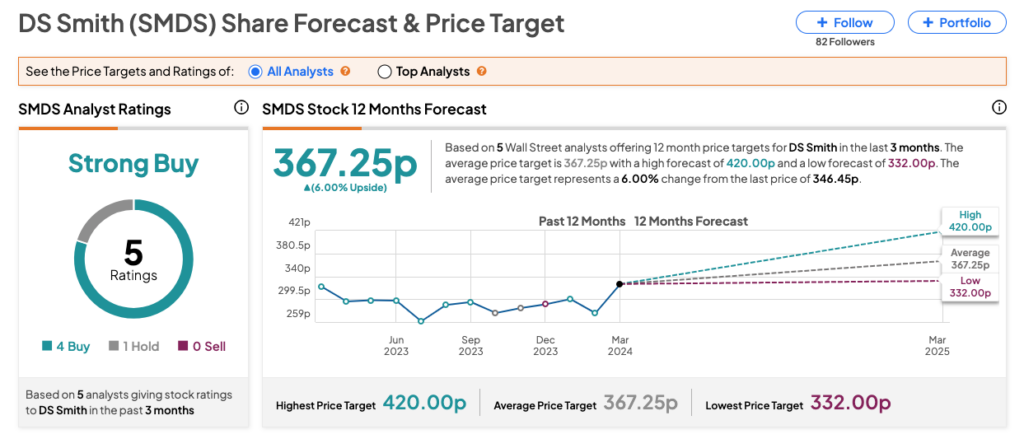

According to TipRanks’ consensus, SMDS stock has received a Strong buy rating, backed by four Buys and one Hold recommendation. The DS Smith share price forecast is 367.25p, which is 6% above the current trading levels.