Dax 40-listed Commerzbank AG (DE:CBK) has acquired a 74.9% stake in a Germany-based asset manager, Aquila Capital, to strengthen its income base and grow its sustainability business. The remaining 25.1% will be retained by Aquila’s parent company, Aquila Group. The deal’s completion is anticipated in the second quarter of this year, subject to regulatory approvals. Post-announcement, Commerzbank shares gained 2.32% in Thursday’s trading.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Commerzbank provides a wide range of banking services, catering to both private and corporate clients.

The Deal Rationale

Aquila Capital specializes in investments in clean energy and sustainable infrastructure. It currently oversees €14.6 billion on behalf of institutional investors globally. With this deal, Commerzbank aims to capitalize on the growing demand for sustainable investments. Additionally, by expanding into asset management, the bank aims to diversify its revenue streams by tapping into more stable sources of income.

The bank further stated that the deal is expected to play a crucial role in achieving the targeted growth in commission income and meeting the revenue goals set for 2027. The bank is targeting a RoTE (return on tangible equity) surpassing 11% by 2027, alongside a targeted net profit of €3.4 billion.

For the first nine months of 2023, Commerzbank reported a net profit of €1.8 billion, marking a significant increase from the €963 million recorded in the same period of 2022. For the full year 2023, it projects a net profit of €2.2 billion and a RoTE of 7.5%.

The bank will release its Q4 2023 numbers on February 15, 2024.

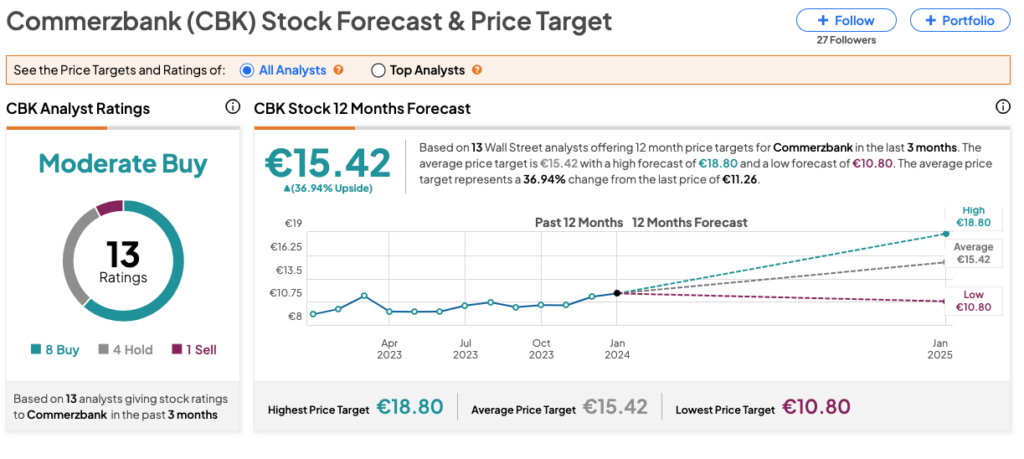

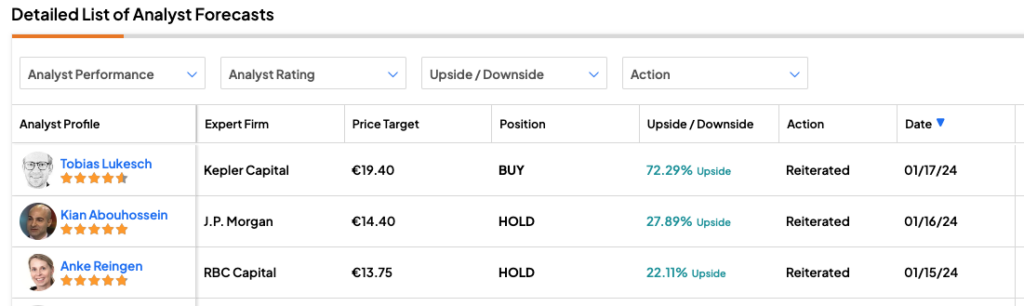

What is the Price Target for Commerzbank?

Recently, analysts gave mixed reviews on Commerzbank stock after Reuters reported that it could merge with Deutsche Bank (DE:DBK) to raise billions of euros.

Overall, CBK stock has received a Moderate Buy consensus rating on TipRanks, backed by eight Buys, four Holds, and one Sell recommendation. The Commerzbank share price forecast is €15.42, which implies a growth of 37% from the current trading level.