Germany’s banking giants Commerzbank AG (DE:CBK) and Deutsche Bank (DE:DBK) could end up merging, a Reuters report said. The German state seeks to raise billions of euros by selling its stake sale to Deutsche Bank. During the height of the financial crisis of 2008, Germany took a significant stake in the then-troubled Commerzbank. Currently, the state owns a 15% stake in the lender.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Commerzbank is a German bank offering private and corporate banking services. Deutsche Bank is one of the leading universal banks offering investment, financial, and related products and services to private individuals, corporate entities, and institutional clients worldwide. Both banks are a constituent of the DAX-40 index.

History of Commerzbank and Deutsche Bank’s M&A Talks

Five years ago, Deutsche Bank contemplated acquiring Commerzbank but then dropped the plans. Reasons cited included additional restructuring costs, already steepening losses for both banks, plunging stock prices, and, most importantly, massive job cuts for overlapping roles.

However, the banks have stabilized and are making positive bottom-line contributions. Merging with Commerzbank would enable Deutsche Bank to become a bigger player in pure banking operations and move away from unpredictable investment banking services. Deutsche Bank has stepped up its M&A efforts with regard to several smaller banks. Although there is no certainty of any active dialogue between the two lenders, internal sources say that Deutsche Bank is considering restarting the talks.

On the other hand, the German government hopes to liquidate its investments in over 100 companies and raise up to €4 billion. The government wants to channel the funds to the state-owned rail company, Deutsche Bahn. Sources say that Germany has also hired an investment bank to advise on its potential sale of Commerzbank’s stake.

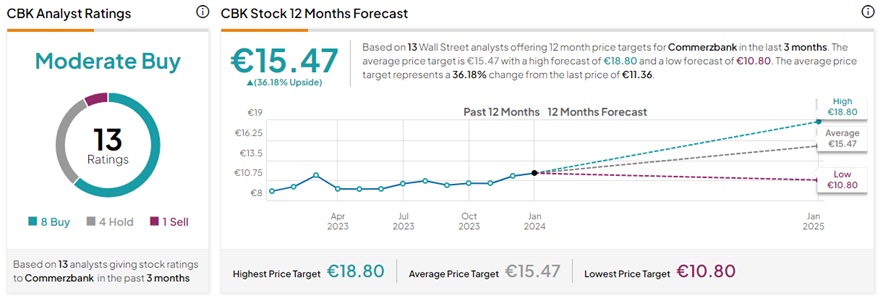

What is the Price Target for Commerzbank?

On TipRanks, CBK stock has a Moderate Buy consensus rating based on eight Buys, four Holds, and one Sell recommendation. The Commerzbank share price target of €15.47 implies 36.2% upside potential from current levels. CBK shares have gained 22.5% in the past year.

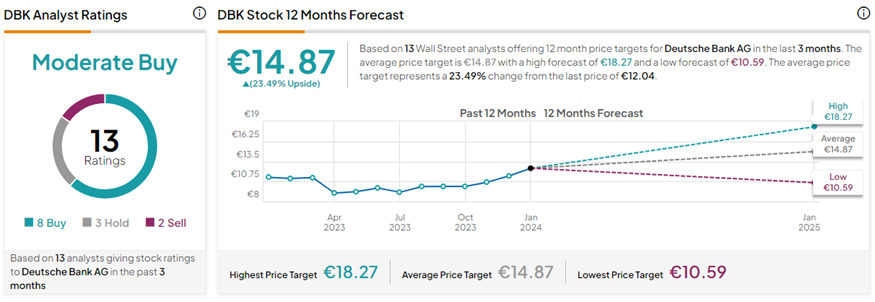

Is Deutsche Bank a Buy or sell?

With eight Buys, three Holds, and two Sell ratings, DBK stock has a Moderate Buy consensus rating on TipRanks. The Deutsche Bank share price forecast of €14.87 implies 23.5% upside potential from current levels. DBK shares have gained 5.3% in the past year.