Shares of ASX-listed Super Retail Group Limited (AU:SUL) hit a fresh 52-week high of AU$16.99 today following a robust first-half Fiscal 2024 trading update. As per the preliminary report, Super Retail’s sales rose 3% to hit AU$2.02 billion in the six months ending December 30, 2023. Also, the first-half profit before tax is anticipated in the range of AU$200 to AU$203 million.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Super Retail is one of Australia and New Zealand’s largest retailers. It owns four renowned brands, namely Supercheap Auto, rebel, BCF, and Macpac. SUL shares have gained over 35% in the past year. Super Retail will release its audited final results for the first half on February 22, 2024.

Super Retail’s H1 FY24 Performance

BCF was the highest contributor, with an 8% rise in sales in the first half. Meanwhile, both Supercheap Auto and Macpac delivered a 4% sales growth. The rebel brand was the only loser, with a 1% decline in sales. For the reported period, the overall group like-for-like sales grew a modest 1%.

Group CEO Anthony Heraghty noted that Super Retail performed well during the cyber sales and Christmas holiday trading periods. Even so, Heraghty warned that toward the end of the Fiscal second quarter, the Group witnessed increased wages, rents, and electricity expenses. Additionally, cost of living pressures on the consumer impacted the retail backdrop and the company’s performance. Despite these challenges, the gross margin for the first half of 2024 is expected to be better than the same period last year.

Further, Heraghty said that over 40% of rebel’s 3.9 million active club members used the new customer loyalty program launched in October 2023. Hence, rebel’s first half profit includes AU$5 million of deferred revenue provision to account for the loyalty credits issued to customers. For the full year, the figure is close to AU$8 million.

Is Super Retail Group a Good Buy?

Goldman Sachs analyst Lisa Deng certainly likes the Super Retail story as it is the firm’s top pick in Australia and New Zealand’s domestic discretionary retail space. Deng is encouraged by SUL’s trading update with solid holiday sales and gross margin expansion.

Deng looks forward to more clarity on the trading momentum in the first few weeks of 2024, when the company will announce its results next month. Deng maintained a Buy rating on SUL stock with a price target of AU$14.40 before the market opened (13.8% downside potential).

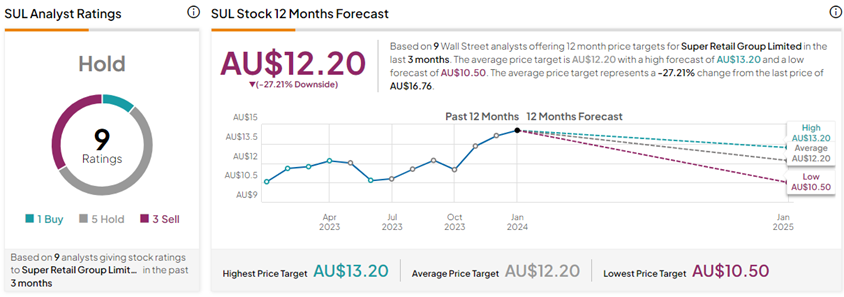

The other analysts are not so enthusiastic about SUL stock. On TipRanks, SUL has a Hold consensus rating based on one Buy, five Holds, and three Sell ratings. The Super Retail Group share price forecast of AU$12.20 implies 27.2% downside potential from current levels.