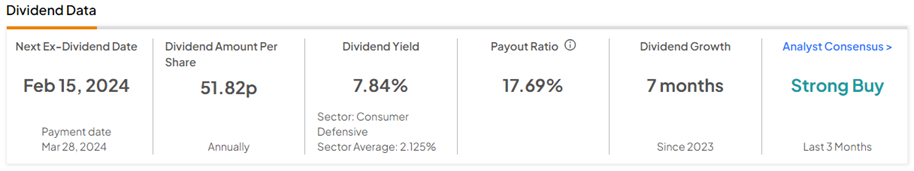

FTSE 100-listed Imperial Brands (GB:IMB) offers an incredibly attractive dividend yield of 7.8%. Imperial Brands is a British multinational tobacco company. IMB is the world’s fourth-largest international cigarette company by market share and the world’s largest producer of fine-cut tobacco and tobacco papers.

The company will pay an interim dividend of 51.82p per share on 29 December 2023. Also, a final dividend of 51.82p per share will be due on 28 March 2024 to shareholders as of 16 February 2024. This payment is 4% higher than the prior year, in tandem with IMB’s progressive dividend policy.

Further, IMB earns a Perfect 10 Smart Score on the TipRanks rating system, implying that the stock is most likely to outperform expectations. Stocks with a Perfect 10 Smart Score make a lucrative investment choice, as these stocks have historically outperformed the S&P 500 index (SPX) by a wide margin.

TipRanks provides a range of tools to assist users in identifying suitable dividend stocks that align with their preferences. We leveraged the TipRanks’ Top Dividend Shares page for the UK market to identify IMB stock. This tool simplifies the stock selection process, making it efficient for users seeking specific dividend investments.

Imperial Brands Expects Solid FY24 Performance

Imperial Brands raised its annual dividend by 4% and increased the share buybacks by 10% in FY23. The company expects its FY24 shareholder returns to exceed £2.4 billion, up from £2.3 billion in FY23.

During its Fiscal 2023 annual results, announced on November 14, IMB stated that it expects revenue and profits to increase next year, with stronger results expected in the second half of the fiscal year.

In the first half of FY24, IMB forecasts slower growth in revenue and profits due to tough year-over-year comparisons. This is because Imperial Brands registered solid growth in the first half of 2023, thanks to significant price increases. Additionally, investments in tobacco alternatives are expected to impact the first half of FY24.

Is Imperial Brands a Good Buy?

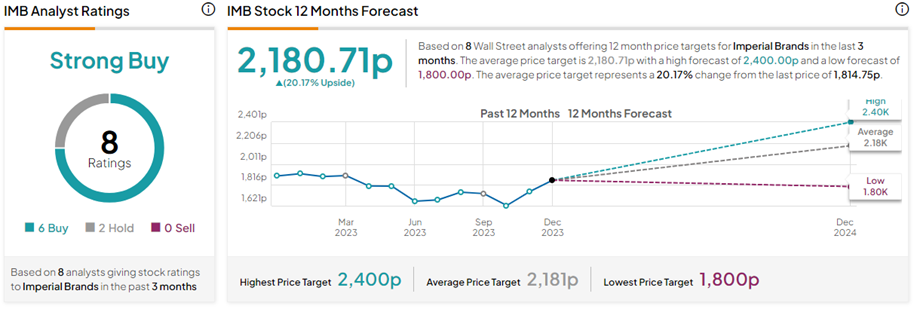

On TipRanks, IMB stock commands a Strong Buy consensus rating based on six Buys and two Hold ratings. The Imperial Brands share price forecast of 2,180.71p implies 20.2% upside potential from current levels. Year-to-date, IMB shares have lost 6.5%.