British financial giant Lloyds Banking Group (GB:LLOY) is Bank of America (BofA) analysts’ top banking pick for 2024. Essential pointers cited by the firm include a narrower net interest margin (NIM) decline compared to peers, greater non-interest income contribution, and a robust share buyback plan underway in Q4 FY23.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

FTSE 100-listed Lloyds Banking Group is one of the oldest and largest banks in the U.K., offering a wide variety of services. It operates through retail, commercial banking, and insurance and wealth units. LLOY shares have gained 3.2% in the past year.

Rationale Behind BofA’s Bullish View on LLOY

BofA analysts retained a Buy rating on LLOY with a price target of 59p (25.1% upside potential) in a sectoral review of the U.K. banking sector. Analysts expect interest rates to fall significantly in 2024 and 2025 as global central banks undertake rate cuts in the coming months. This will impact banks’ net interest incomes (NIIs) and margins. At the same time, it will induce volumes and improve the asset/loan qualities. Notably, mortgage rates have started receding with house prices falling and housing sentiment improving, the bank added.

BofA cut earnings forecasts for U.K. banks by 7% to 12% for 2024 and even by a higher rate for 2025. Even so, BofA has retained an above consensus earnings forecast for Lloyds Banking Group. The analysts believe LLOY will see mid-teens RoTE (return on total equity) and continued mid-teens yields. Also, BofA expects Lloyd’s non-interest income to grow in the high single digits.

What is the Future of Lloyds Banking Shares?

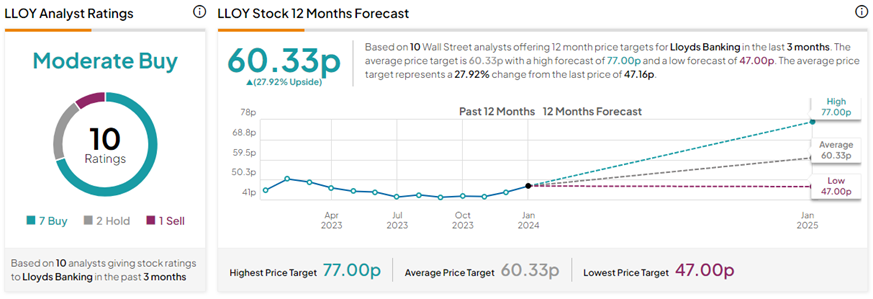

On TipRanks, six other analysts echo similar bullish views for LLOY stock as BofA analysts. Meanwhile, two analysts have a Hold rating, and one has a Sell rating on Lloyds shares. Based on these, LLOY stock has a Moderate Buy consensus rating. Moreover, the Lloyds Banking Group share price forecast of 60.33p implies 27.9% upside potential from current levels.